The further education sector plays an important role in England’s education system. In 2017/18, the country’s 266 colleges provided education and training to 300,000 apprentices, 600,000 young people aged 16 to 18, and 1.4 million adults.

However, it has also received an average 30 per cent funding cut from 2009 to 2019 and staffing levels which have slumped by 20,000 since 2010. What’s more, across the UK, the FE estate structure is changing, with a shift towards regional colleges which have strong links with each other, independent providers and industry.

Simply put, colleges are under immense pressure to deliver high-quality education with dwindling resources – they suffer more than any other stage of education. So how can our FE establishments reshape to be more productive and financially stable, while also providing an excellent learning experience that produces a workforce with the skills required to help the UK economy thrive post-Brexit and beyond? The answer lies in digital transformation.

The tools are out there to not only reimagine productivity from automating processes but also by enabling educators to rethink the way they work. For example, by choosing an integrated learner Management Information System (MIS) such as Advanced’s ProSolution, FE providers can quickly and responsively manage applications and enquiries, learner enrolment, registers, timetables, examinations, reporting and oversee the production of Individualised Learner Records (ILRs). These tools can unleash a new era of collaboration – as well as competition – between FE providers, where the most successful organisations will be those that use technology to facilitate smooth and successful partnerships between themselves, students and employers.

Easing the burden of Ofsted

While accurate and ongoing self-assessment is crucial for continued improvement in teaching and training delivery, Ofsted Inspection is one area that continues to cause FE establishments a big headache.

Ofsted’s latest Annual Report revealed that more than 80 per cent of teachers say inspections create ‘unacceptable burden’, with four fifths of teachers stating that Ofsted inspections create additional work. So how can productivity be improved in this area?

Alongside automating dozens of previously manual processes, feedback from colleges indicate that our ProSuite helps to support compliance, providing a very reliable audit trail. For example, this proved invaluable when, in September 2016, just five months after rolling out the software, Grimsby Institute of Further & Higher Education started preparing the data for its next Ofsted inspection.

The Institute uses ProAchieve to gain the vital information that all FE colleges and all types of private training providers need to improve learner and organisation performance, whilst at the same time ensuring they remain compliant and prepared for Ofsted with the ever-changing and demanding government and inspection standards.

Ricky Coxon, Executive Director of Information Services at Grimsby Institute, said: “We knew we were doing an outstanding job with regards to learner progress, attainment and attendance – and Advanced’s solution helped us showcase this. Teachers and support staff could focus on any areas of weakness and put in place improvement plans to instigate change for positive outcomes. When we pulled it all together, our data looked very strong. We found we were six per cent above the national average for 16-18 year olds, and above in almost all other areas, too.”

By combining technology solutions, staff were able to access higher quality student data and work more efficiently – all of which helped the college to gather important evidence required for the inspection. Impressively, Grimsby Institute won the highly coveted ‘outstanding’ rating from Ofsted – held by less than one per cent of the general FE colleges in England.

This shows first hand how data can help bring together hundreds of staff to deliver positive outcomes. Over 95 per cent of all further education colleges in England use Advanced ProSuite, with 25 per cent of customers reporting that they feel “well prepared” for Ofsted Inspections after implementing the software. Imagine the impact on British teaching and learning if all educational institutions embraced technology and put data at the heart of their insight.

Six key areas where technology could boost productivity in FE

Increasing efficiency when it comes to managing data for Ofsted inspections is just one area that technology can help increase productivity in FE. It can also reshape and personalise learning, boost productivity in the staff room, and improve strategic and operational decision making, particularly around teaching, learning support, and curriculum design. It can:

- Speed up administration and reporting, freeing up staff to focus on boosting student outcomes

Standard procedures such as student enrolment, completion, transfer or withdrawal can now be done in minutes. As a result, 70 per cent of institutions benefit from time-savings through acquiring the ProSuite, with 43 per cent of customers saving two or more hours per day after implementing one of Advanced’s solutions. Grimsby Institute saved time on approximately 240,000 enrolments, completions, transfers and withdrawals during 2016/2017 and became nearly 200 per cent more efficient on these tasks – the equivalent of freeing up 11 people – allowing staff to focus on improving student outcomes and boosting college operations.

- Boost learner outcomes

Integrated software like Advanced’s ProMonitor is key for teaching staff to track learners. It has modules designed for a range of users to access individual learner data, to write reports and to ease the administrative burden of marking. Holding a centralised collection of key learner details, the system makes it easier to raise, track and follow up on comments and understand your learners. The email integration can notify those who need to know, keeping everyone in the loop. Each learner can also have their induction and meetings recorded, building a detailed picture of them. This is especially useful in cases where learners need additional support, or become at risk, allowing teachers/FE institutions to create actions plans to reduce learners risk status. It can also be customised to design multiple individual learner plans.

- Improve transparency

Alongside the ability to automate dozens of previously manual processes, technology solutions can also support compliance, providing a reliable audit trail. If the data is questioned, the processes are so transparent that it’s easy for colleges to see exactly who entered the data, find the source of that data and quickly rectify it.

- Reveal trends and highlights areas of weakness

By integrating systems, such as finance and HR, student information can be kept up-to-date centrally, providing a single real-time view of student data across the college, and delivering increased confidence in the analysis and trends that are revealed. Tools such as ProObserve help staff streamline lesson observations so they can focus efforts where needed, resulting in greater learner progress across the board.

- Show real-time information in one place

Improving outcomes, measuring progression and retaining learners are the main goals for FE organisations. Having the right information available is key to keeping learners on track and ensuring they meet their potential. With most college data tied up in multiple systems, the process of pulling it all together is manual and laborious, using up time that could be better spent teaching. A dashboard solution, such as Advanced’s ProMetrix, can help provide valuable insight to guide a retention strategy, monitor students’ progress, assess course effectiveness, direct decisions and resource allocations. Some 83 per cent of customers believe the ProSuite allows them to effectively analyse the success of courses and departments for continuous improvement.

- Increase successful interactions with employers and prospective students

FE colleges and training providers face significant challenges in terms of maximising access to employers and stakeholders whilst contributing to the government’s target of achieving three million apprenticeships by 2020. ProEngage is a specialist CRM solution, designed for the FE market that can manage and help to increase successful interactions with employers and prospective students.

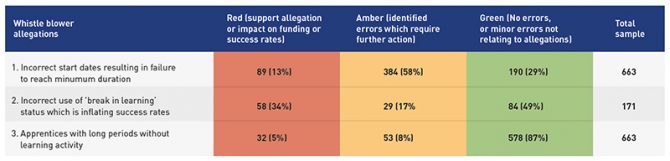

Apprenticeships: training providers need to get a handle on data

The Government recently announced that training providers will be asked to log apprentices’ off-the-job training hours to prove that the minimum funding requirement is being met. A new data field for Individual Learner Records (ILR) has been designed to help providers demonstrate compliance. Data must be recorded monthly and contribute to each learner’s full ILR.

Further guidance on the new field explains that it should record the “cumulative total of actual off-the-job training delivered to date, to the individual apprentice, in the academic year by the training provider”.

While having the right information available is key to keeping learners on track and ensuring they meet their potential, training providers argue that such processes are heavily labour intensive, taking up hours of admin. There is a smarter way. Advanced’s solution, ProAchieve, gives training providers easier access to the vital information they need around learner achievement.

By replicating a variety of ESFA and Ofsted reports, ProAchieve enables training providers to see clearly how well they are performing across year groups and whether they are on track. They can view learning aims and learner data from the ILR, as well as funding data from the Funding Information Suite (FIS) and Provider Financial Report (PFR) files. Using ProAchieve means they can also easily look up values such as demographics and learner details, plus use the extensive data filtering functionality to highlight key information to facilitate the drive to improve performance.

Implementing integrated systems from one supplier like this is a simple way to deliver the efficiencies that all training providers are seeking.

How technology made Aylesbury College more productive

Aylesbury College, part of Buckinghamshire College Group, needed to simplify its student administration, making it more efficient, so that staff could spend more time focusing on learners and their education.

The college was already using ProAchieve to analyse student retention and achievement, and ensure it was meeting targets. On the back of this success, it implemented Advanced’s MIS solution to make it easier to centralise, maintain and report on data. This would enable student enrolment, registration, timetables and examinations to be managed more productively.

Using the software suite meant all the college’s systems could work immediately as one cohesive whole. This meant teachers could take registration on different devices, including mobile, with the data immediately available online. With lesson attendance a key indicator of student success, the college could immediately take appropriate action for any students who are absent. It also afforded them the time to give greater care to their ‘looked after’ and ‘safeguarded’ students.

The system has also reshaped the college’s ability to take a holistic view of all the components in its study programme, linking the data and giving a single view of each student. For the first time, the college can tie attendance figures together with learning, student programmes and target grades, and has seen a marked improvement in student achievement as a direct result.

Fiona Morey, Deputy Principal of Buckinghamshire College Group, commented: “We wanted to integrate all our systems, and the solutions within the suite now communicate seamlessly with each other.”

Following Aylesbury’s merger with Amersham and Wycombe College, the amalgamated systems can maximise the benefits and efficiencies that the college was looking to achieve. With all information in one place, the college can easily analyse vital data so that it is making informed decisions to ensure its learners get the best possible outcomes. Staff across all sites have streamlined access to crucial data, with dashboards showing a real-time view of learner attendance and progress. As a result, the college is now agile enough to respond to student information with speed and accuracy. Implementing ProMonitor, to further help gauge student success, will be the last piece of the jigsaw.

“ProSolution is simple, powerful and has a huge impact on the efficiency of our organisation, helping us to monitor and analyse our students’ activity, retention and achievement so that we can continue to evolve and deliver an outstanding academic experience.”

Reimagine your goals from a new perspective, and gain the time to rethink, recharge and reshape your college. Find out more today

If you want to find out more about how we support 95% of FE colleges in England each year, click here.