The 10-per-cent fee that small businesses must pay when they take on apprentices could be scrapped, according to the AELP.

Its boss Mark Dawe revealed that the skills minister is having “ongoing conversations about a change in policy” regarding the co-investment rule, in an exclusive interview with FE Week ahead of his association’s national conference next week.

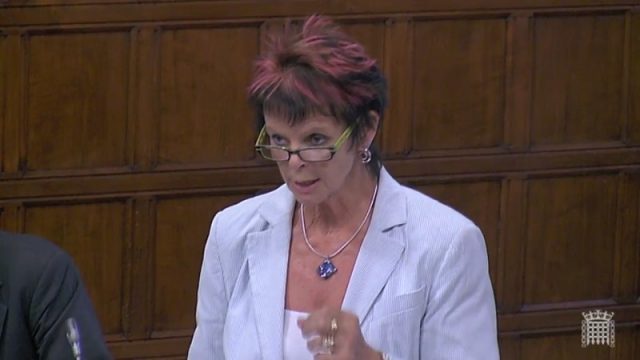

Anne Milton has since said it is an issue she is seriously looking at, but wouldn’t be drawn on whether there would be any immediate announcement.

“Our big ask is for the minister to make the announcement that the 10-per-cent contribution requirement is to be removed for non-levy-payers or levy-payers who go over their levy if they are delivering level two and three apprenticeships to the under 25s,” Mr Dawe said.

“We made a proposition for a transition period to try it out until April. I don’t know if the minister will be able to do it this quickly but I know there are ongoing conversations about it, I’m just not sure if they’ll be able to announce it on Monday.

“If the minister announced that [at the AELP conference] then she would get a standing ovation and we could probably close the conference.”

The apprenticeship levy is paid by employers with an annual payroll of £3 million or more, who can then spend their contributions on apprenticeship training.

Smaller employers can also access the funds generated through the levy, although they must pay 10 per cent towards the cost of the training.

There was no mandatory charge before May last year, simply an assumed contribution for apprentices aged 19 and over.

Since last May, only 16- to 18-year-olds at employers with fewer than 50 staff are fully funded and therefore free to train.

The AELP has been heavily campaigning to remove the 10-per-cent rule as it believes it puts SMEs off apprenticeships, and is the reason why starts have fallen so much since the introduction of the levy.

Latest figures show that starts for March were down 52 per cent compared with the same period in 2017.

“That is where the numbers are being really hit – the lower levels for young people and in the SME market,” Mr Dawe said.

Ms Milton later admitted to FE Week that she is “keeping an open mind” on the policy.

However, she is “not having any conversations with the Treasury” at this stage.

“I’m working with businesses to find out what particular problems they have and a lot of it is around the understanding of what they can and can’t do,” she told FE Week. “That would apply to non-levy payers and small businesses.

“I think a lot of them don’t realise that we will pay 90 per cent of the training or maybe 100 per cent in certain circumstances.

“I am mindful that we need to make it work for small businesses and how much impact that 10-per-cent contribution has. I make no promises but we are monitoring everything.”

Ms Milton added that she is organising a roundtable event with SMEs to “find out exactly what is going on” with their experience of apprenticeships.

The 10-per-cent contribution rule is expected to be a hot topic at the AELP national conference, taking place in west London next week from June 25 to 26.

FE Week is media partner and will be live tweeting from @feweek throughout, as well as producing a supplement sponsored by NCFE with coverage from the first day.

Given the current weakness in the number of new apprenticeship starts, and with Brexit now firmly on the horizon, wouldn’t it be a timely boost for SMEs to have this charge removed? SMEs are vital for the apprenticeship system to succeed, offering comfortably the most significant pool from which to drive up apprenticeship numbers.

If SMEs are no longer responsible for apprenticeship fees, then not only will their business benefit from gaining new motivated employees, it would also provide people with more opportunities to access a scheme, thus helping to narrow the UK’s skills gap.

Let’s hope the Government is prepared to take this bold step forward to provide greater support for SMEs and the apprenticeship system as a whole.