Just over a quarter of applications for FE loans had not been successfully processed by the end of October, new figures have revealed.

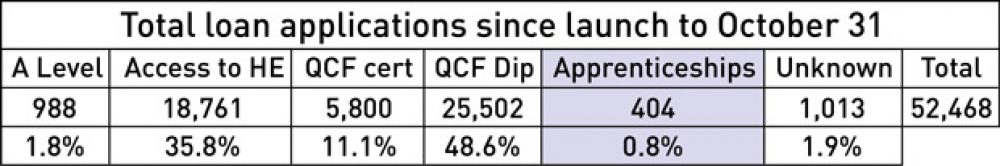

The Department for Business, Innovation and Skills (BIS) confirmed 52,468 applications had been lodged, seven months after 24+ advanced learning loans were first introduced.

But most recent figures show 13,425 applications were not ready for payment, which works out at 26 per cent.

A further 1,212 applications had been processed, but deemed “ineligible” by the Student Loans Company (SLC).

The Association of Colleges (AoC) confirmed it had raised concern with the SLC that the application system was not working as efficiently for FE learner as for higher education students.

Julian Gravatt (pictured), AoC assistant chief executive, said: “The SLC’s processes are fast for those who supply all the information at the right time, but slower for those who have a missing piece of information.

“This works well for full-time higher education students who apply months in advance, but is more problematic for walk-in enrolments at colleges.

“The priority for colleges at the moment is to ensure that loan applications continue to be converted into loan confirmations.

“There are some areas of the system which need improvement which AoC has taken up with the SLC.”

An SLC spokesperson confirmed the company was prepared to review how it processes FE loans.

He said: “We continue to review and develop the guidance we offer about information needed when applying for a loan, as we seek to continuously improve the service available to all applicants.”

The figures showed a continuing trend of low take-up for apprenticeship loans, as just 404 applications had been lodged.

Apprentices did not have to pay anything towards their training costs before the system was introduced in April for courses starting from August.

Sector leaders expressed concern that fear of paying off loans, that could run to several thousand pounds, was putting young people off apprenticeships.

Stewart Segal, chief executive for the Association of Employment and Learning Providers, and David Hughes, chief executive of the National Institute of Adult Continuing Education, claimed the system was failing and called on the government to take “radical action”.

The take-up is well below government forecasts of 25,000 applications for apprenticeship loans this academic year (by July 31, 2014).

A BIS spokesperson conceded there was an issue with apprentice loans.

He said: “The introduction of loans to FE has been very successful. However, application numbers indicate that employers and learners are not engaging with loans in apprenticeships.

“We are keeping a close watch on the data and the implications for the apprenticeship programme.”

24,596 Apprenticeship applications to go in the next 8 months…!? There are plenty of examples of the apprenticeship market moving to a price point of free for employers and learners since the days of Train to Gain.

Even though the L3 Advanced programmes have been cited as critical to our economic growth, moving from free to a loan funded programme where anecdotal commentary (of scale) would suggest that only specific components of Apprenticeship frameworks are actually in demand from employers and learners, we shouldn’t be surprised at this low level of applications. Couple this with the current routing of funding through contracted providers, ‘selling’ a L3 Loan funded Apprenticeship over a ‘free’ L2 Apprenticeship has been an easy decision to make. It’ll be interesting to see if employer routed funding and increased awareness improves the position, but I doubt it will get anywhere near 25,000.