The chancellor has drawn up plans to restrict the use of levy funding for degree-level apprenticeships, FE Week understands.

Multiple sources have said that Jeremy Hunt is concerned about the affordability of the levy amid a huge rise in the number of costly level 6 and 7 apprenticeships for older employees, while spending on lower levels and young people falls.

Treasury officials have now floated the idea of limiting the use of levy cash that can be spent on the highest-level apprenticeships, but the Department for Education is understood to be resisting ahead of next week’s Autumn statement.

Proposals include removing some apprenticeships – such as the popular but controversial level 7 senior leader standard – from the scope of levy funding, introducing age restrictions and demanding larger employer contributions.

Networks of training providers and universities contacted the Treasury this week to plead with the chancellor not to cut access to the courses, who claim the move is “political posturing” to appeal to certain parts of the electorate.

Those involved in delivering the courses have also argued that the majority of level 6 and 7 management apprentices are in public services and “critical for the productivity agenda and fiscal sustainability”.

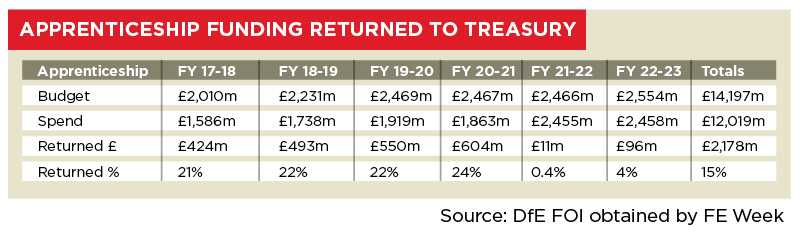

Experts have called on the government instead to increase the apprenticeships budget in line with the level of levy receipts the tax brings in. The government was accused of short-changing employers in September after FE Week analysis revealed the Treasury failed to distribute around £415 million paid into the levy by employers in the 2022-23 financial year.

Ciaran Roche, public affairs manager at the Association of Employment and Learning Providers, said his membership body understands that the government wants more levy funds to be spent on level 2 to 5 apprenticeships, but the “best way to do this would be to increase the apprenticeship programme budget to match the increased apprenticeship levy take”.

Roche added that, while the details are still being negotiated, the proposed changes to level 6 and 7 apprenticeships “could introduce more complexity to an already complex system”.

Restriction plans are ‘political posturing’

The levy was introduced in 2017 and forces employers with a wage bill of £3 million or more to hand over 0.5 per cent of their annual wage bill to fund apprenticeships across the UK.

The government’s apprenticeships quango, the Institute of Apprenticeships and Technical Education, and spending watchdog the National Audit Office warned in 2018 that the scheme was not financially sustainable as the average cost of training apprentices hit double the figure that was expected when the levy was designed.

Ministers then began considering “hard choices” about ways to limit levy spending, but pressure eased when the Covid-19 pandemic hit in March 2020 and the number of new starters fell.

However, figures for 2021-22 and 2022-23 show that 99.6 per cent and 96 per cent of England’s apprenticeships budget was spent respectively. This was despite starts dipping overall compared to the early years of the levy, and down to of soaring numbers of higher-level apprenticeship starts.

Skills minister Robert Halfon, who has made boosting the number of degree-level apprenticeships one of his top priorities, batted away concerns about the affordability of the budget this year in an interview with FE Week. He insisted there were no talks about imposing controls on levy spending.

FE Week later revealed that, since the levy was introduced, spending on level 6 and 7 apprenticeships has risen from £44 million in 2017/18 to £506 million in 2021/22 – hitting £1.325 billion in total over that period. It now accounts for over a fifth of England’s annual apprenticeship budget.

Spending on level 2 apprenticeships dropped by a third over that period, from £622 million to £421 million.

Levy spending on those aged 25 and over more than doubled between 2017/18 and 2021/22, growing from £460 million to £934 million. At the same time, spending on apprenticeships for young people aged 16 to 19 fell by £60 million, or about 10 per cent, from £686 million to £626 million.

The most popular degree-level apprenticeship is the level 7 accountancy/taxation professional, which racked up 9,470 starts in 2021/22 and 41,370 in total since 2017. With an upper funding band of £21,000, this standard could use up to £870 million of the levy pot from the starts already recorded.

The second-most popular degree-level apprenticeship is the level 7 senior leader standard, which has had 25,200 starts in total since 2017/18. With an initial funding band of £18,000 before being cut to £14,000, it means that up to £420 million could be used to fund this training.

However, starts for this particular apprenticeship have begun to drop since the government removed its controversial MBA component from the scope of levy funding.

A final decision on whether to restrict levy funding for degree-level apprenticeships could come as soon as next week.

The DfE and Treasury declined to comment.

About time too. Most of this is dead weight. As a former kpmg partner we funded all of our own training, now most accountancy firms fund it via the levy and indeed overspend and pay the 10% for more. It is simply wrong and I have been saying since the start of the levy.

Make the large employers pay 30% towards the cost and then let’s see what commitment they have to apprenticeships because before the levy most of them didn’t recruit 18 year olds because they apparently weren’t mature enough.

The accountancy firms, the law firms and the public sector will chase the cash !

Stop it now and also abolish EPAO as another dead weight

Enabling firms to spend the levy fund on a more flexible variety of accredited and modular training supporting the upskilling and productivity growth our economy needs is what is needed. Further restrictions is a move in the wrong direction.

As stated, the apprenticeship budget has not increased in line with increased levy take. If the appetite is there for apprenticeships, and the government are genuinely behind them, then we need a bigger cake.

Deeper dive into the Level 7’s please.

Provide a count of how may L7 standards there are, then the distribution of starts across those standards over the last (x) years.

Then look specifically at the under 19s starts (yes, on Masters level equivalent) and see where they are and in what proportions.

Then consider how is it possible for very specific professions to be attracting some of the very brightest minds… and what does that mean in terms the concentration of talent and how their work benefits society.

‘We’re putting employers in charge of the Apprenticeship process’…

Well at least we will until they spend their Levy on something we don’t like.

You coudn’t write this stuff could you.

It is not right that we spend more on L6 & 7 apprenticeships than on 16-18 year old apprenticeships, so something needs to be done. I would prefer that we start by spending all that is raised by the levy.

Degree apprenticeships are largely replacing previous degree level training that was previously funded by the employer, they are not necessarily adding new degrees. Baroness Wolf warned explicitly against this possibility and described such apprenticeships as “deadweight”. Sadly, a significant number of apprenticeships at the higher levels are in this “deadweight” category. They are disproportionately extracting funds at the same time as a catastrophic fall in the foundational Level 2 apprenticeships that are important to many of the SMEs that employ more people than all of the large businesses added together. Not only does Level 2 reflect a key activity level, it is also the level for many new starters, including young people out of school. Many of them find the opportunity to move to the higher levels via this route, that would otherwise be beyond their aspirations. However, simply excluding degree level funding to release cash will not resolve the problem on its own. The current standards based system is simply too inflexible, Trailblazers are useless for diverse small businesses that don’t have the time or resources to engage in them, and even when standards are available they are frequently undeliverable because the combination of small cohort sizes and low funding bands mean that providers cannot economically deliver. Unless the system is redesigned and an acceptable replacement for frameworks is created, the Apprenticeship Levy will continue to be the outstanding failure that adds bureaucracy, cost and no value. This is not being adequately represented in the changes currently advocated.