Incoming tax rises on hairdressing salons could eliminate popular apprenticeship places in the industry within two years, a new report has suggested.

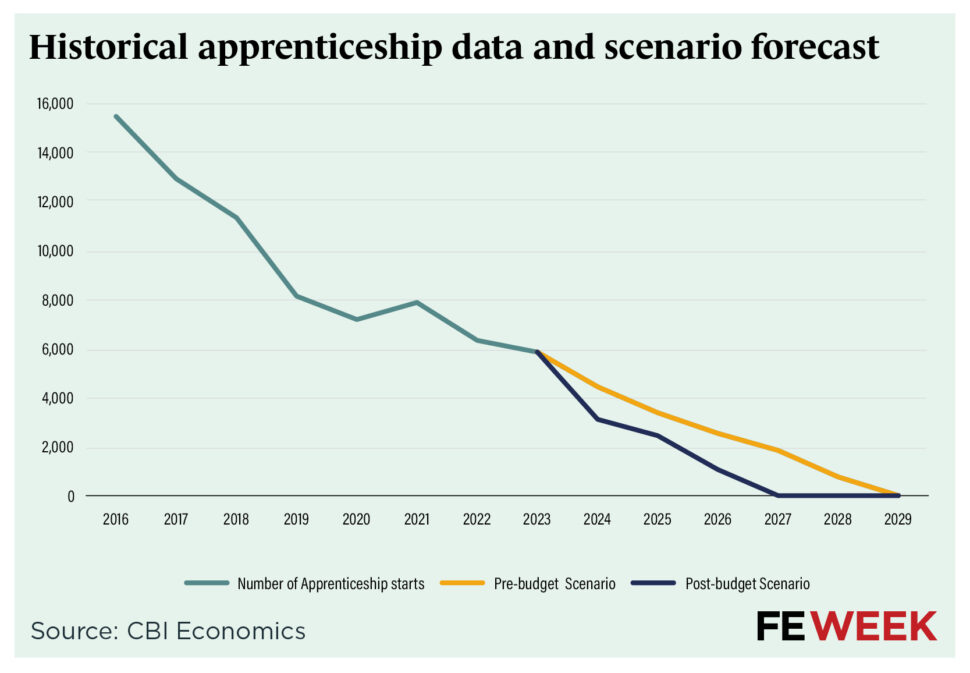

Forecasts by CBI Economics, on behalf of the British Hair Consortium (BHC), show apprentice numbers in hairdressing and beauty dropped from 16,000 to 6,000 between 2016 and 2023, and could be 0 in 2027.

The report, published this week, said tax rises from the government’s autumn budget will accelerate the decline in apprenticeships.

It says: “In simple terms, it has been unaffordable to take on and train apprentices for many years now and the decline shows this trend that can only be reversed by a fundamental change for employing businesses who train the next generation.”

‘Unlevel playing field’

CBI Economics research suggests that apprentice numbers have been driven down by a growing trend of employers cutting their tax burden by hiring self-employed staff.

This is creating an “unlevel playing field” between salons that mainly hire self-employed workers and traditional employer salons that tend to invest in apprentices.

Toby Dicker, co-founder of the Salon Employers Association, said: “The recent budget has accelerated the move to self-employment.

“I don’t blame anyone but it’s happening and has been happening for a long time, that’s going to reduce the tax going to the Treasury and is going to basically eradicate apprenticeships.”

Surveys of more than 2,000 salon owners also suggest that the Labour government’s recent budget decision to increase national insurance rates and national minimum wage increases will accelerate the rate of decline of hairdressing apprentices.

But apprenticeships are preferred

Apprenticeships are understood to be the preferred training route for the hairdressing and salon sector.

This was one of the key reasons hair and beauty T Levels were dropped last year, despite extensive marketing and millions of pounds spent on new college facilities and staff training.

Hairdressing professional remains one of the top five most popular apprenticeship standards for under 19s, with 3,800 to 4,500 starts each year between 2020-21 and 2023-24.

Of the 2,130 starts in quarter one of this academic year (August to October), 91 per cent were under 19 and 96 per cent were female.

Dicker said: “[Apprenticeships] are favoured by 95 per cent of employers in the industry.

“The only true way in is through apprenticeships because we need those hands-on skills. You need that work experience of life of talking to people”

The BHC argues that salons have a disproportionately high tax burden compared to other high street businesses because they have more employees and sell fewer goods, resulting in lower VAT refunds.

They estimate that a salon with a turnover of £1.2 million pays three times more tax than other retail businesses with the same turnover.

The Treasury should take a “necessary correction” by cutting VAT rates on salon labour-based services to 10 per cent, the report argues.

Apprenticeship model under threat

Laura Geary, director at Headmasters, which has more than 50 salons and two apprenticeship training academies, said: “The changes from the last budget have made it very hard for salons to continue to offer the benefits of employment and we will certainly not be able to take on as many apprentices going forward.

“This will kill the future of our industry.”

Using DfE estimates of the benefits of apprenticeships, CBI Economics estimate that the fall in apprenticeships since 2016 means society has “foregone” about £3.2 billion in lifetime productivity benefits.

The analysis argues that this could “jeopardise the sector’s labour supply for years to come”.

Charlie Collinge, director at Collinge & Co, a group of training salons across the north west, said: “Last year we had over 300 applications but were only able to find employment for 60 apprentices because fewer salons can afford to take them on.

“Apprenticeships are the main route for sustainable careers in hairdressing, but the model is under threat if there aren’t enough salons able to directly employ hairdressers.”

The DfE has been approached for comment.

A HM Treasury spokesperson said: “We delivered a once-in-a-Parliament budget to wipe the slate clean, now we are focused on going further and faster to kickstart economic growth so working people have more money in their pockets.

“We’re also levelling the playing field for high street businesses, including hairdressers, by permanently cutting business rates and removing the £110,000 cap for over 280,000 retail, hospitality and leisure business properties, while also capping corporation tax for the duration of parliament.”

The first of many unintended consequences of new government policies.

The apprenticeship reforms unintended consequences will be along in 12 months.

It’s no good blaming the straw for breaking the camels back. It’s the underlying crippling ground rent cost that is the real issue, not a few recent tax changes (the straw).

The businesses are just stuck in the middle, so look to reduce exposure to risk by distancing themselves from direct employment (hence fewer PAYE apprentices).

In much of the hairdressing world, hairdressers rent a chair in a salon for £x per day and the individual takes all the risk. As long as the business owner is renting out enough chairs to make a margin, they stay in business. If the building is rented, the owner can decide to squeeze the business as much as they think they can. They don’t care that the risk is passed down the chain to a self employed individual, what they see is the return on investment. If the property has a mortgage on it, then there are even more fingers in the pie…

It’s another manifestation of the uberisation of the workforce. £’s first, people second.

How long before we see self employed retail workers, administrators, finance, IT…?

The standards of both candidates and the training providers have fallen massively in the last 10 years or so.Trainees that want to dictate their training,a certificate qualification given for 16-20 months training and an ever shrinking skill set required.

As a hairdresser of 40 years I see myself getting busier and busier simply because I am reliable,competent and can hold a conversation.We are an industry that has let down the customer and the trainee.