Income from the government’s controversial “skills tax” on migrant visas has fallen for the first time in four years, new Home Office figures reveal.

The immigration skills charge (ISC) was introduced in 2017 as a tax on employers who sponsor visas for workers recruited from overseas to “incentivise” training British workers instead.

Income was supposed to fund programmes that “address skills gaps in the UK workforce”, but the Treasury has faced criticism for treating it as “simply a tax” that goes into its main “consolidated fund”.

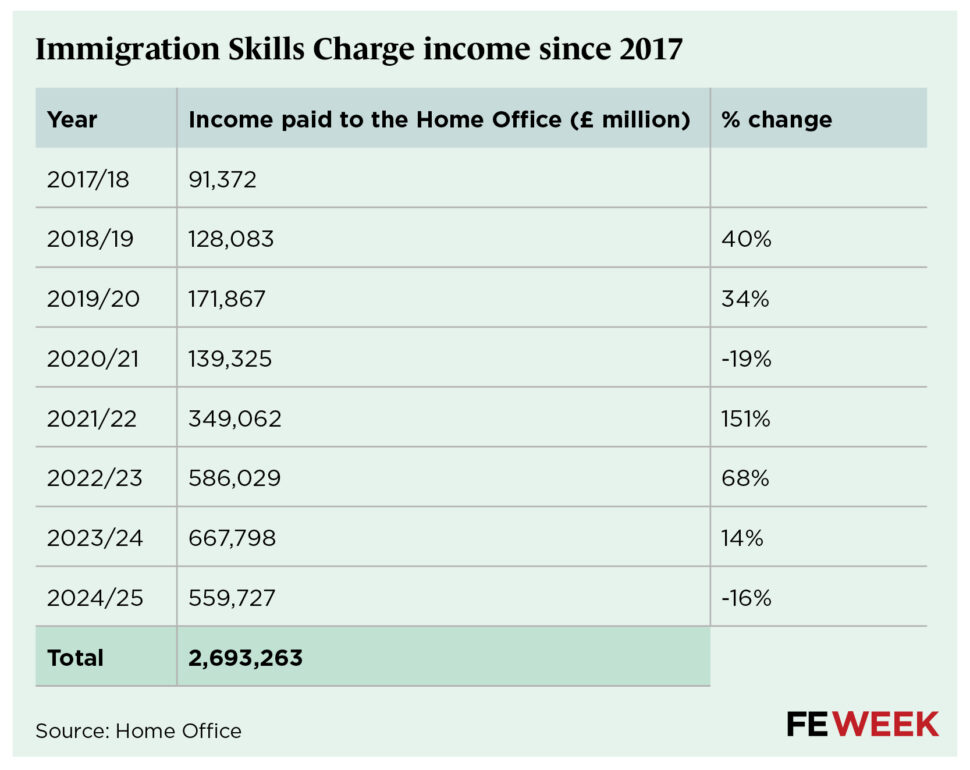

The government has raised a total of £2.7 billion from the ISC so far, with income increasing almost every year to a record high of £668 million in 2023-24.

But according to the Home Office’s annual report, published earlier this month, income dropped 16 per cent to £559 million in 2024-25.

It comes ahead of a proposed 32 per cent increase in the ISC, announced in the government’s immigration white paper alongside a government pledge to “end the chronic underinvestment in domestic skills that has hindered economic growth”.

The fall in income, the first since 2020-21, is likely to reflect “wider labour market shifts”, according to the Chartered Institute of Professional Development (CIPD).

Lizzie Crowley, senior skills advisor at CIPD, said this could include “cooling demand for labour in some sectors” and ongoing “economic uncertainty”.

However, Crowley told FE Week the “lack of transparency and clarity” around how the income is spent is the “bigger issue” with the charge.

She said: “If the charge is truly to deliver on its purpose, the funds should be ringfenced for skills investment and allocated transparently, with a clear link to programmes that tackle shortages in the UK workforce.”

Treasury ‘snaffling’

Former skills minister Robert Halfon said: “I think they need to be very transparent about how much of this is coming back towards skills.

“It’s in the nature of the Treasury, even with supposed special taxes, to snaffle away some of the money.

“This money is for skills and should be spent on skills, and we need to be transparent on how this is spent.”

A Treasury spokesperson claimed any enquiries about the charge should be directed to the Home Office.

The Home Office has been contacted for comment.

The incoming charge

The government’s immigration white paper said the one-third increase, the first in eight years, will “bring the ISC rates in line with inflation”.

Small businesses or charities will now have to pay £480, up from £364 for the first 12 months of hiring a migrant, and then £240 (originally £182) extra every additional six months.

Medium to large “sponsors” will now pay in £1,320 for the first year, up from £1,000, and £660 for the subsequent six months, up from £500.

It remains unclear when the new rates will come into force.

When the increase was announced, it faced criticism from expert bodies including the British Chambers of Commerce (BCC), techUK, and the Institute of Directors.

Jane Gratton, deputy director of public policy at the BCC said: “Businesses prefer to employ people from their local labour market.

“Accessing the immigration system is costly and complex, and only 1 in 10 employers we surveyed use it, often as a last resort when they can’t get the skills they need in the UK.

“The immigration skills charge adds to the high cost of employment that is being piled onto business.

“So the money raised from it should be fully ringfenced for skills to help build the domestic talent pipeline. The growth and skills levy should also be ringfenced in its entirety to help boost skills in the workforce.”

Is this in some way linked to the ‘ladder of opportunity’?