The government should reverse the “failure” of the apprenticeship levy by tripling the number of businesses that pay into it and releasing all funding raised by the tax to be spent on training, a Labour-linked think tank has said.

In its new report “Levying-Up: how to make the growth and skills levy work”, the Fabian Society argues that the levy system has crashed on its key goals of increasing the number of apprentices, meeting employers’ skills needs and driving social mobility.

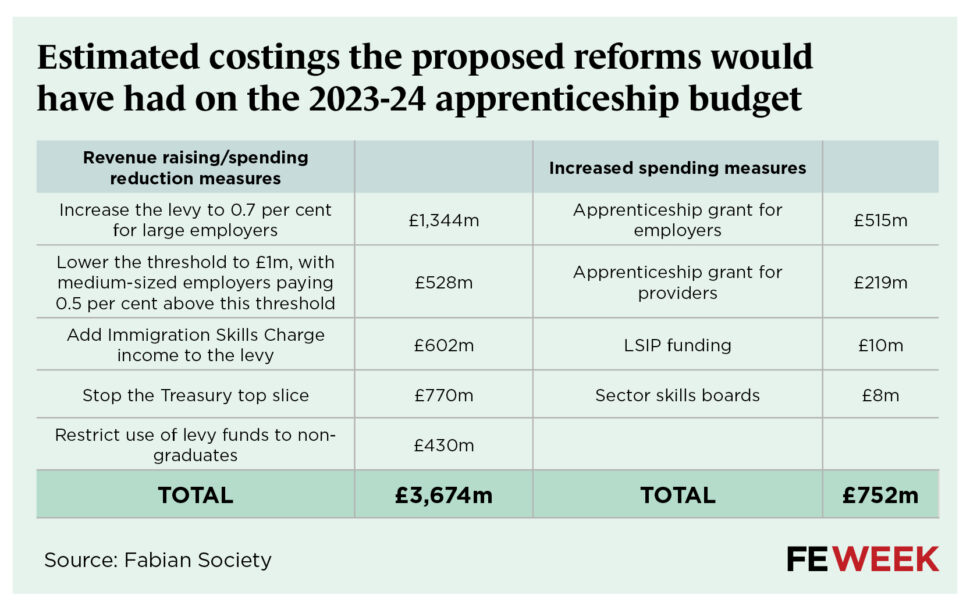

To “unleash growth and unlock opportunity”, the government should create a new “growth and skills fund” worth more about £5.5 billion – double its 2023-24 value – by lowering the levy threshold, increasing the cost for large businesses, and forcing the Treasury to ringfence income from skills charges for training.

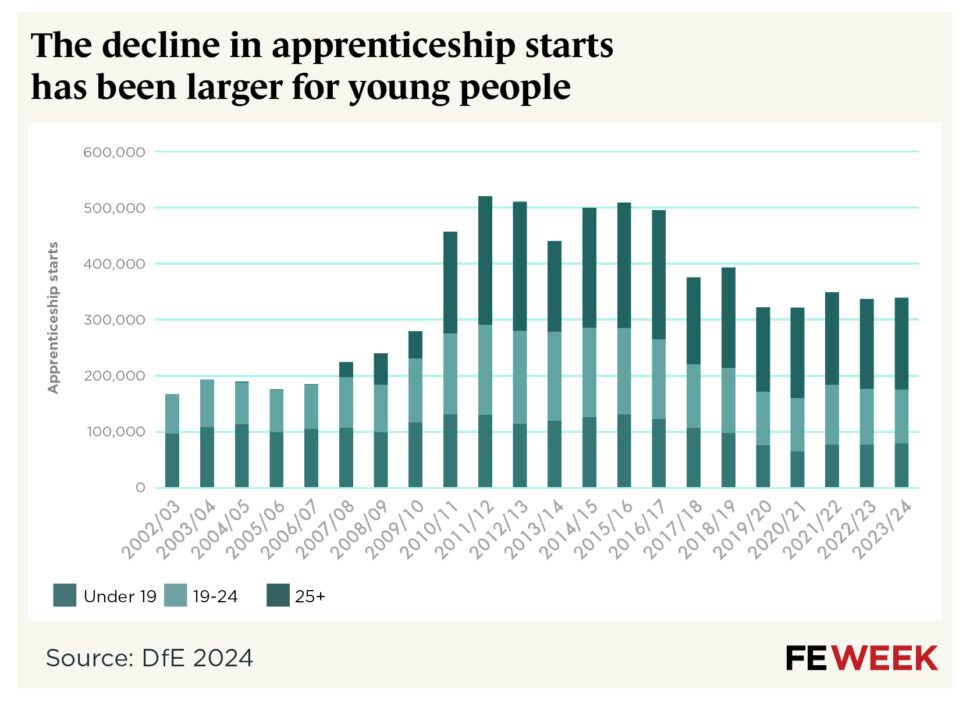

The report calls the levy system an “abject failure” at creating more apprenticeships, which have “plummeted” by 31 per cent since its launch in 2017 – especially “letting down” small and medium sized employers (SMEs) where the number of starts is down by half (48 per cent) – or at boosting employer investment in skills, which fell by £9.5 billion to about £44 billion between 2017 and 2024.

Report co-author Joe Dromey, Fabian Society general secretary, said the number of entry-level opportunities for young people has also “collapsed”, while employers have “increasingly invested in workers who are already well qualified”.

He added: “The government’s commitment to reform the levy is hugely welcome, but we need to see progress soon. The growth and skills levy must seek both to boost employer investment, and to redirect it towards those who could most benefit.”

‘Growth and skills fund’

Labour is currently reforming the apprenticeship levy into a “growth and skills levy”, where an unspecified portion can be spent on non-apprenticeship training in some priority sectors linked to the industrial strategy from April 2026.

The Fabian Society wants the government to go further. Its proposals include lowering the levy threshold from companies with a payroll of £3 million or more to £1 million, to ensure more SMEs have “skin in the game”.

Combined with increasing contributions from large employers from 0.5 to 0.7 per cent, levy revenue would grow by £2.55 billion, giving greater “headroom” to the budget (currently £3.075), which overspent for the first time in 2024-25.

However, results from a survey of 2,000 employers this year showed 60 per cent of non-levy payers opposed extending the levy, while 39 per cent supported a levy increase in return for increased flexibility.

The report said: “The decline in both apprenticeship starts and employer investment represents a drag on growth, contributing to growing skills gaps, and sluggish productivity growth.

“In reforming the levy, the government should seek to boost the size of the funding pot available to employers, enabling both more flexibility in how funds can be used, and greater total investment in skills, without a decline in apprenticeship numbers.

“It should do so through ensuring all funds raised by the levy are invested in skills, and through both increasing the levy and broadening the levy over time.”

End levy top-slice and lump in immigration skills charge

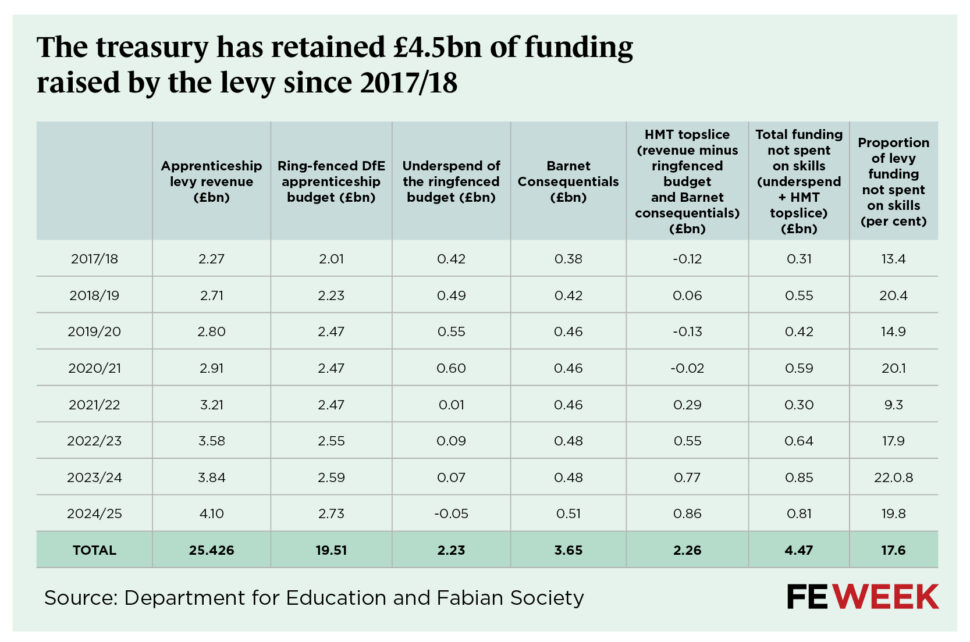

The report also argues that the Treasury should no longer retain its near-20 per cent top-slice of apprenticeship levy income. Updated analysis shows that between 2017-18 and 2024-25, £4.5 billion of funding raised by the apprenticeship levy was retained by the Treasury.

Government should also ringfence income from the immigration skills charge (ICS), which raised £668 million in 2023-24.

The ICS is a charge on employers who bring skilled foreign workers into the UK, introduced in 2017 with the promise of putting revenue “towards addressing skills gaps”, although how the funding is spent has never been confirmed.

Labour’s immigration white paper included plans to increase the charge by 32 per cent and pledged to use the ICS to support training in priority sectors.

The government faces “clear policy choices and difficult trade-offs” if it wants to avoid either another overspend or a “further decrease” in apprenticeship starts if flexibilities are added to the levy system, the report warns.

But it nonetheless argues that its revenue-raising proposals would create the financial headroom to give employers “greater flexibility” on what type of training they can spend the levy on.

This should be guided by Skills England and new sector skills boards to “lead” the system, as well as the industrial strategy, migration policy and devolved local government.

Rebalanced investment

The levy system has made the UK’s “stark inequalities” worse as funding is increasingly spent on higher level apprenticeships, for older and more educated learners, in more prosperous regions of England, and in large businesses, the report argues.

It added: “This shift is bad for growth, given apprenticeships for older workers have poorer labour market returns, and those at higher levels offer worse value for money.”

A key cause of this is the Conservative government’s “flawed ideology” that put employers in charge, which failed to either boost growth or widen opportunity because businesses chose to “rebadge” existing training as apprenticeships and maximised investment in their current staff and “alienated” SMEs.

The report also cites Department for Education statistics suggesting that apprenticeship starts in the most deprived neighbourhoods declined by 47 per cent between 2017 and 2024, while those in the least deprived declined by only 11 per cent.

To counter this “highly unbalanced” system, the Fabian Society has backed calls to ban graduates from levy-funded apprenticeships.

It said only apprenticeships for workers without a degree level qualification should be funded through the levy.

In addition to the restrictions to level 7 apprenticeships coming in from January 2026, this measure “would save £250 million, which should be redirected to investment for young people and lower-level qualifications”.

Bring back AGE grants

Government should also bring back grants for employers and providers to reverse the decline in starts at SMEs (48 per cent) and for young people (34 per cent), at an estimated cost of £515 million from the new, larger growth and skills levy.

The Fabian Society’s employer survey suggests a grant of £3,000 per start for SMEs employing an apprentice aged 16 to 25 would be “effective at incentivising employers”. The report argues that a previous scheme offering an employers’ grant between 2012 and 2017, known as the Apprenticeship Grant for Employers (AGE), was also “effective”.

A grant should also be created to incentivise providers to work with SMEs and young apprentices, with £1,000 and £1,500 available for each respectively, to “help them through the process”.

However, the survey suggested incentives were the least popular proposal to increase young apprentices, behind pre-apprenticeship training, advice and support, and restricting levy funding.

Overall, employers were “evenly split” on whether the levy should be more focused on young workers, with 39 per cent in favour and 39 per cent preferring an all-ages approach.

A DfE spokesperson said: “We are transforming the apprenticeship levy into a new growth and skills levy, which will offer greater flexibility to employers and learners and support the industrial strategy.

“In August we introduced new foundation apprenticeships for young people in targeted sectors, as well as shorter duration apprenticeships to break down barriers to opportunity and drive economic growth through our Plan for Change.

“To support business and boost opportunity the Government announced at the Spending Review that we will spend £1.2 billion more on skills by 2028/29, to ensure young people are developing the skills they need to succeed.”

Totally agree that the skills system is wildly skewed. Blaming employers for that is absolutely bonkers though. Despite much establishment rhetoric to the contrary, the skills system in England has never been employer led. It is, and is ever likely to be, government led. Employers are just playing the cards they were dealt.