The government’s response to the Richard Review has been branded a “fudge” that fails to address the need for “reform of funding incentives”.

Shadow FE Minister Gordon Marsden spoke out as the government published its response to the review, The Future of Apprenticeships in England: Next Steps from the Richard Review.

The government’s response, which includes a 24-question consultation, comes four months after Doug Richard’s independent review of apprenticeships.

Business Secretary Vince Cable described the response and its plans to “empower employers”, as “radically changing” the way apprenticeships were delivered.

But Mr Marsden questioned ministerial commitment to employer ownership, saying: “Ministers appear to have comprehensively ducked Richard’s recommendations over ways of incentivising employers to take on apprentices via reforming funding schemes.”

Former Dragons’ Den investor Mr Richard, has insisted that tax incentives for employers through National Insurance or a tax credit system were central to his views on apprenticeship reform.

In November he told FE Week: “I feel strongly about this point and I think it’s the heart of the review.”

The Association of Employment and Learning Providers, which has rejected his tax breaks argument, said it was pleased the government had held back from “any firm commitment” to the idea. The group said it had “warned the government” that any adoption of Mr Richard’s tax credits proposal was “fraught with danger”.

But when pressed on the matter during a webinar hosted by FE Week, FE minister Matthew Hancock appeared not to have ruled out the idea.

“We are looking at all the options,” he said.

And the UK Commission for Employment and Skills, which championed tax incentives in its new report Employer Ownership of Skills Building the Momentum, further hinted the government was working towards the measure.

Michael Davis, chief executive of the commission, which has run employer ownership pilots for the government, said he didn’t believe ministers had “gone cold” on the proposal but that the tax incentives scheme required “a lot more work”.

“I see this as a work in progress,” he told FE Week.

“The minister has been very supportive . . . and the government has said as much on it at this point as it can.

“You have to take this forward in manageable pieces, and tax and direct payments take a lot of thinking. The commission’s view is that tax is a long-term proposition to hard wire vocational training into the labour market.

Maternity pay just happens in the labour market — and it works — but it took a lot of hard work first.”

He said the commission’s preferred way to fund apprenticeships would be to use National Insurance, a model that worked for all businesses, organisations and charities.

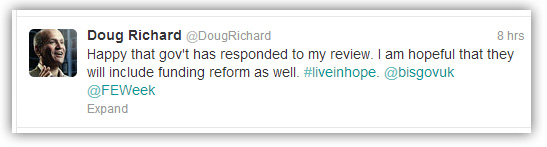

Mr Richard tweeted shortly after the response was published (see below) and told FE Week: “I continue to hope that the government will ensure that the reform takes into account the need for a change in the approach to funding. I am pleased to see that it continues to explore new approaches.”

The consultation ends on May 22.

———————————————————————————————————————

Editorial: Heart of the matter

In November last year, Doug Richard said he felt strongly about apprenticeship funding reform, and his preferred option was through the national insurance system or as a tax credit.

In fact he said it was “at the heart” of his “all-or-nothing” review.

Then, in December, the FE Minister Matthew Hancock announced he would be excluding apprenticeships from the Skills Funding Agency reform of adult funding for 2013/14, so he could consider Mr Richard’s proposals.

Fast-forward to March, and the government response contains neither a critique of funding apprenticeships this way, nor even any related questions in the consultation.

So an obvious question is, putting it anatomically, what’s happened to the heart?

The minister made it clear in an FE Week webinar that funding apprenticeships in the future via the tax system remained an option.

Yet, to repeat the point, the government consultation makes no proposals and asks no questions relating to the chapter on employer purchasing power.

Of course, the decision to reform apprenticeship funding in this way probably now rests with the Treasury, but would it not want to know if the sector, and more importantly employers, thought it would be a better system?

But there may be a work-around, so let me make a recommendation.

Use the ‘any further comments’ final consultation question — number 24 — to make your voice heard.

Nick Linford, FE Week editor

I comepleted the quesionnaire last night. I suggested that the cadidate be given half the amount it actually costs to deliver a good quaity Apprenticeship (as opposed to the wet finger in the air equation the SFA currently uses). With thstey go to an employer and get them to take them on. If they do, the employer receives matched funding from the Govt and both parties use that money to pay for the training. The training can take whatever form the candidate and employer wants – in house, distance learning, training provider or a combination. The outcomes are measured regularly by a VOCATIONALLY COMPETENT (as opposed to a civil servant or Ofsted inspector) Training Verifier who ‘signs of’ stages of the programme.

The way it is funded will ultimately determine how it is delivered, and how it is delivered will ultimately determine the quality of the progamme.