A sixth form college was lauded as ‘outstanding’ in a mixed week for FE, which saw one private provider plummet to ‘inadequate’ while another dropped two grades to ‘requires improvement’.

Godalming College was given the top rating by Ofsted in its first inspection since converting to a 16 to 19 academy in January 2018.

The Surrey-based college has around 1,900 students, who “thrive in the atmosphere of industrious learning,” with a large majority studying A-level courses.

Inspectors found they “make strong and sustained progress with their learning and achieve excellent examination grades”.

Staff were praised for supporting students who fall behind or need extra help “very effectively” and for revisiting topics, providing “clear” feedback and distributing “useful” careers advice.

In contrast, independent learning provider Icon Vocational Training Limited dropped from a grade one to a grade three.

It works with about 118 employers within the leisure and sport industry and currently has 309 apprentices.

While Ofsted said many apprentices benefit from frequent feedback and gain promotion due to their participation in the programme, some do not develop significant new knowledge for their vocational areas rapidly enough because “leaders and managers do not plan and sequence the curriculum to take into account the previous experiences of apprentices”.

Engagement with smaller employers was deemed “not as successful” as it is with the large employers.

Recent improvement actions to address these issues are “only just beginning to have a positive impact,” according to inspectors.

Another private provider to receive a grade three this week was Seymour Davies Limited.

It has 68 apprentices across care, business administration and carpentry as well as 108 adults working in the care sector who are enrolled on short-duration qualifications in care.

The inspectorate said carpentry apprentices, taught by a subcontractor, become “highly skilled very quickly”.

However, it was reported that too few taught by the prime provider “receive high-quality off-the-job training or prompt feedback on the quality of their work” and “most have not completed their qualifications in the time planned”.

Tutors have “significant industrial experience” which helps apprentices to link theoretical concepts to the real-life situations that they face at work, but careers guidance was also criticised.

Chesterfield College, a general FE college, received a second grade three in two years.

At the time of the inspection, it had 2,000 learners aged 16 to 18, 900 adult learners and 1,500 apprentices across three main sites in Chesterfield and three satellite apprenticeship centres in Derby, Manchester and Nottingham.

Ofsted found learners “do not always receive high-quality training” and those with high needs “do not receive personalised training”.

The report said “leaders have not improved the quality of education for young people rapidly enough”.

Elsewhere, the education watchdog found North Lincolnshire Council, an adult and community learning provider, was making ‘reasonable progress’ in its first re-inspection monitoring visit following a full inspection in June 2019 – which found it to be ‘inadequate’.

In addition, Derwen College, an ‘outstanding’ independent specialist college, received a monitoring visit after safeguarding “concerns” were brought to Ofsted’s attention.

It provides education and support for learners with special educational needs and disabilities.

The college was found to be making ‘reasonable progress’ in ensuring that effective arrangements are in place to safeguard learners, frequently reviewing them and making improvements as a result.

As reported earlier in the week, Progress to Excellence Ltd was declared ‘inadequate’ and is immediately exiting the training market, leaving more than 2,500 apprentices and adult learners in the lurch.

Meanwhile, Ofsted reported that apprentices “thoroughly enjoy their learning” and are “highly motivated to do well” at private provider Bright Direction Training Limited.

Similar praise was offered to fellow provider Louise Setton, where apprentices “benefit from a high level of support and technical training”.

Both firm’s received grade twos in their first full inspections.

Hull Business Training Centre Limited was also rated ‘good’ – maintaining the grade it has retained since 2005.

The remaining independent learning providers inspected by Ofsted this week received positive reports following monitoring visits.

Primary Goal Ltd was found to be making ‘significant progress’ in one area and ‘reasonable progress’ in the other two assessed themes.

Both Cambridge Professional Academy Limited and Parenta Training Limited received ‘reasonable progress’ across the board.

Employer provider Kingswood Learning and Leisure Group also made ‘reasonable progress’ in a second monitoring visit, after receiving three ‘insufficient progress’ grades in September.

But British Airways PLC was given one ‘insufficient progress’ rating out of three in its first monitoring visit (read the full story here).

| Independent Learning Providers | Inspected | Published | Grade | Previous grade |

| Bright Direction Training Limited | 12/12/2019 | 21/01/2020 | 2 | M |

| Cambridge Professional Academy Limited | 12/12/2019 | 20/01/2020 | M | N/A |

| Hull Business Training Centre Limited | 12/12/2019 | 21/01/2020 | 2 | 2 |

| Icon Vocational Training Limited | 13/12/2019 | 24/01/2020 | 3 | 1 |

| Louise Setton | 12/12/2019 | 21/01/2020 | 2 | M |

| Parenta Training Limited | 17/12/2019 | 21/01/2020 | M | M |

| Primary Goal Ltd | 12/12/2019 | 20/01/2020 | M | N/A |

| Progress to Excellence Ltd | 16/12/2019 | 22/01/2020 | 4 | 2 |

| Seymour Davies Ltd | 29/11/2019 | 20/01/2020 | 3 | M |

| Sixth Form Colleges (inc 16-19 academies) | Inspected | Published | Grade | Previous grade |

| Godalming College | 06/12/2019 | 21/01/2020 | 1 | N/A |

| Adult and Community Learning | Inspected | Published | Grade | Previous grade |

| North Lincolnshire Council | 10/01/2020 | 24/01/2020 | M | 4 |

| Employer providers | Inspected | Published | Grade | Previous grade |

| British Airways PLC | 18/12/2019 | 19/01/2020 | M | N/A |

| Kingswood Learning and Leisure Group | 11/12/2019 | 22/01/2020 | M | M |

| Specialist colleges | Inspected | Published | Grade | Previous grade |

| Derwen College | 08/01/2020 | 22/01/2020 | M | 1 |

| General FE colleges | Inspected | Published | Grade | Previous grade |

| Chesterfield College | 28/11/2019 | 24/01/2020 | 3 | 3 |

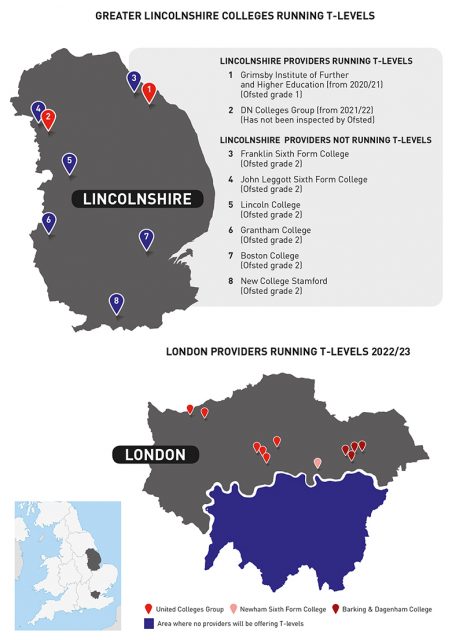

New College Stamford has been part of the capacity and delivery fund piloting industry placements: they met their target of putting 74 learners on placements last ear; but Meenaghan believes that while well over 100 will be placed this year, they will struggle to meet their target of around 142.

New College Stamford has been part of the capacity and delivery fund piloting industry placements: they met their target of putting 74 learners on placements last ear; but Meenaghan believes that while well over 100 will be placed this year, they will struggle to meet their target of around 142.