FE has drawn the spotlight of the national press, after the government refused to rule out a hike in the levy after its launch next April.

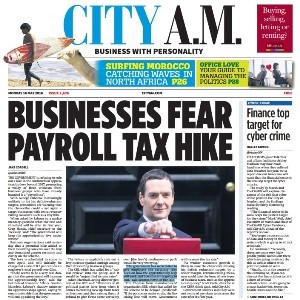

City A.M.’s front page today raised concern that the chancellor could look to raise extra income from businesses – through new revenue raising measures, including a potential increase of the levy.

It came after Greg Hands (pictured above), chief secretary to the Treasury, was asked in a parliamentary question from Labour what the rate and threshold of the levy would be in in 2017-18, 2018-19 and 2019-20.

Mr Hands declined to give a clear answer, saying: “The government has confirmed that the apprenticeship levy will be set at a rate of 0.5 per cent of company paybill and every employer will have a £15,000 allowance to offset against their levy liability.

Mr Hands declined to give a clear answer, saying: “The government has confirmed that the apprenticeship levy will be set at a rate of 0.5 per cent of company paybill and every employer will have a £15,000 allowance to offset against their levy liability.

“In practice, this means only employers with paybills greater than £3m will pay the levy.”

But he added: “As with all policies, the government will keep the apprenticeship levy under review.”

Calls have been made for greater clarity, following complaints that the prospect of the levy being hiked adds yet another concern about the scheme.

Skills minister, Gordon Marsden, said it seemed “inevitable” the government would end up raising the levy.

He commented: “Having tried to duck answering our parliamentary question first time round, the minister has had to admit that the Treasury could now increase the levy rate on a yearly basis.

“The more we hear from various sources about how the levy will now need to fund the top up, the devolved administrations, English and maths at level two and disadvantaged learners, incentive payments and non-levy payers, the more it seems inevitable that the government will end up raising the levy.”

He added: “This just adds further to the mounting chorus of concerns from employers and providers about the government’s handling of the levy’s implementation from 2017.”

The Confederation of British Industry, which suggested on April 28 that the start date for the levy should be delayed unless a “radical review” took place, said that it would be “unjustified to raise [levy] rates”.

Scott Corfe, director at the Centre for Economics and Business Research think tank, added: “As weaker economic growth is likely to leave the chancellor missing his deficit reduction targets by a wider margin, revenue-raising measures could take the form of new types of business taxes, such as the apprenticeship levy.”

A train crash waiting to happen