An apprenticeship and graduate recruitment agency for schools has been accused of exploiting a tax incentive scheme after it emerged it has been advising schools how to become “better off’ by manipulating apprenticeship levy rules.

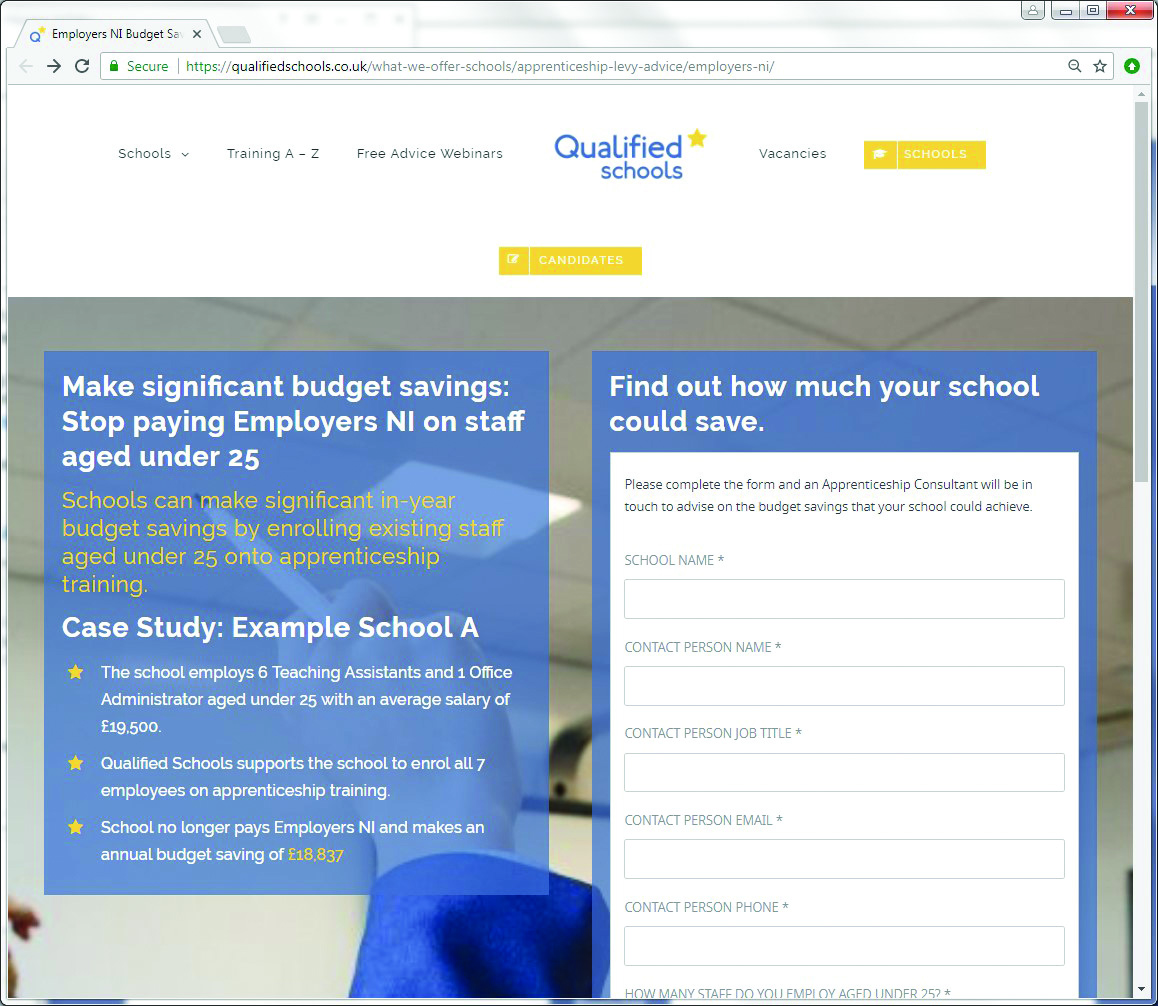

Qualified Schools proudly states on its website that schools can make “significant in-year budget savings” if they choose to enrol existing staff under the age of 25 onto apprenticeship training, as they will no longer have to pay national insurance contributions.

During a webinar held on Monday, a representative advised schools that converting their employees into apprentices would make significant tax savings, even if their levy pot ran out, because the saving is more than employer contributions.

However, a spokesperson for Qualified Schools, which is owned by Education Placement Limited, insisted it “does not encourage schools to spend more than their levy pot or provide financial advice about employer’s NI”.

“We simply make schools aware of government guidance documents and ensure they know all the options available to them so they can make an informed decision about how to spend the levy,” she said.

During Monday’s webinar, which FE Week heard in full without the company’s knowledge, participants were advised that if they have spent their levy amount, or do not pay into the levy, they can save money by training existing employees under the age of 25.

A Qualified Schools employee informed schools that, if they want to train two teaching assistants at a price of £5,000, then the government will co-invest 90 per cent of the costs, leaving the school with a bill for just £500.

He calculated that, by training up existing young employees, schools can make employers’ NI savings of £1,633 per person. By training two people this saving becomes £3,266 and, with the £500 factored in, a school would end up £2,766 “better off” for using the system.

“So while investing in training you’re actually making savings rather than spending, and even when you are spending you’re in a surplus rather than a deficit because of the amount of money you generated from the levy,” he told viewers.

The law changed in April 2016, and anyone employing an apprentice under the age of 25 on an approved UK government statutory apprenticeship framework is not required to pay employer’s NI contributions on their earnings below £43,000 a year.

The advice given by Qualified Schools is not illegal. However, the National Education Union’s joint general secretary, Dr Mary Bousted, warned that the company should not be “encouraging” schools to “avoid paying national insurance”.

“We should also be concerned about any incentive to inappropriately badge existing school staff, who may have no say in the decision, as apprentices,” she said.

“On initial inspection this can be seen as corrupting the apprenticeship brand and is arguably a tax avoidance scheme, which has the potential for so much harm.”

However, the spokesperson for Qualified Schools insisted the company “does not provide financial guidance”.

“The core of the business is the recruitment of apprentices and graduates,” she continued. “Existing staff training and any related savings are not the focus of Qualified Schools but are simply part of a rounded discussion in line with informing schools of their options.”

FE Week also asked the company to its explain why the claim on its website that “training providers pay a subscription to be a part of our approved network”, which suggests it is operating a brokerage model of the kind which training providers are no longer permitted to participate in.

Qualified Schools has since removed the line, saying it had “clearly been misconstrued” and insisted it would update the site “so it is clear we are not brokering public funds”.

A spokesperson for the Department for Education said it did not investigate third-party companies offering apprenticeship advice, but does investigate those suspected of paying for brokerage with money meant for apprenticeship training.

“We are clear that any government funding provided for apprenticeships must be spent on apprenticeship training and assessment only, against an approved network or standard, as set out in our funding rules,” he said.

“This ensures that all apprenticeships are high-quality and give each apprentice the skills and training they need to progress. We will investigate any organisation we suspect of using money meant for apprenticeship training to pay for brokerage.”

However, Qualified Schools insisted it was within Apprenticeship Training Agency (ATA) guidelines for charging training providers a fixed admin fee for every referral made, rather than charging the employer or school.

ATA guidance says a commercial charge should be placed on “the host employer and in some instances on the training provider”. However, Qualified Schools only places the charge on the training provider, and never on the employer/school.

In their own words: The Qualified Schools’ webinar

“I’m going to give you another example which will generate employer NI savings. I just want you to think that you’ve spent your levy amount and you’ve got absolutely no more to spend, or you’re an employer who doesn’t pay into the levy. What we’re going to say is you want to train up two TAs [training assistants] who are under 25. The cost of training for a TA through apprenticeship levy is £2,500 per person so that’s £5,000.

So assume you have no more money to spend through the levy or you’re an employer that doesn’t pay into the levy. So now what you’re doing is that cost of training of £5,000 goes down to £500 because the government will co-invest in training with you saving 90%. So jot down £500. Now if we take into consideration the employers NI savings of £1,633 per person.

What we’ll do is if you times £1,633 by two you will be saving £3,266 on employers’ NI saving. Minus the cost of training with the government’s co-investment of £500, you are actually £2,766 better off as a school than you would be before spending that money on training.

So while investing in training you’re actually making savings rather than spending, and even when you are spending you’re in a surplus rather than a deficit because of the amount of money you’ve generated from the levy.”

Your thoughts