A “radical” overhaul of apprenticeship funding has been outlined by the government in response to a review by former Dragons’ Den investor Doug Richard.

Three funding ‘models’ have been proposed by the Department for Business, Innovation and Skills in A Consultation on Funding Reform for Apprenticeship in England, around nine months after the Richard Review of Apprenticeships came out.

Mr Richard was tasked with looking at how apprenticeships in England could meet the needs of the economy. He said the National Insurance or tax credit system should be used to give employers breaks as payment for training and said such changes should be “at the heart” of apprenticeship reform.

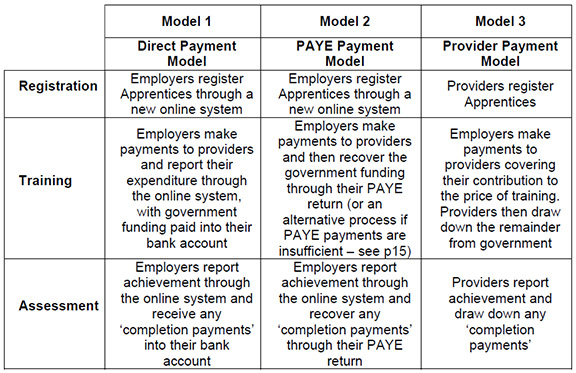

The suggestion figures among those going out to a ten-week consultation (see table below).

The first of the proposals is for a direct payment model where businesses register apprentices claim government funding online.

The second is for a PAYE payment model in which businesses register apprentices online and then recover government funding through their PAYE return.

The third option, although all could be amended as part of the consultation, is a provider payment model where government funding continues to be paid to training providers, but it can only be drawn down when the employer’s financial contribution towards training has been received.

Business Secretary Vince Cable said: “Employers are the best people to judge what training is worth investing in. These radical reforms will mean just that.

“It gives them the power to train their staff to make sure their skills are relevant to the company, instead of having to rely on what courses are available in the local area.”

The government also revealed it was looking at funding 16 to 18s “more generously”.

“We must recognise that younger apprentices have less labour market experience, which means the costs of getting them to the industry standard are potentially higher,” it says in the consultation document.

The first two models would both need the “time-consuming” construction of a new online system, but could be in place by 2016 “at the earliest”.

However, common to each of the models is for “the employer and provider negotiating the content and price of eligible apprenticeship training”. It would replace a system of government-set national funding rates.

Skills Minister Matthew Hancock said: “By radically reforming the funding system we will allow employers to agree with training providers the content and price of training ensuring greater competition both on quality and on price.”

The proposal to use the tax system follows calls for reform from the UK Commission for Employment and Skills.

Its chief executive, Michael Davis, welcomed the consultation.

“The commission’s perspective is that we must return apprenticeships to their founding principle — a contract between the apprentice and the employer, valued and funded as such,” he said.

It sits alongside a review launched by Deputy Prime Minister Nick Clegg into the employment, education and training of 16 to 24-year-olds announced at a Confederation of British Industry dinner on Monday, July 15. The review is due out in the autumn.

However, the Association of Employment and Learning Providers’ chief executive, Stewart Segal, warned against the apprenticeship funding consultation’s PAYE model.

“We have considerable doubts over whether the PAYE proposal would actually bring more employers into the apprenticeship programme,” he said.

“In fact, it might put smaller businesses off. The co-funding option [model 3] might have merit if it properly recognises the contributions which employers make towards an apprentice’s framework achievement.”

Responses to the consultation should be sent to apprenticeships.consultation@bis.gsi.gov.uk by October 1. Visit www.gov.uk/government/news/government-sets-out-radical-plans-to-shake-up-apprenticeship-funding for further details.

———————————————————————————

Editorial: Making employers pay

The truly ‘radical’ element of the government’s apprenticeships consultation is not, as it might first appear, in the different funding mechanisms of the three suggested models.

Nor is it that the employer would ‘own’ the delivery.

What is radical is that, in each of proposals, the employer would have to make a cash contribution.

Public co-investment already stands at 50 per cent of full funding, yet anecdotal evidence is that few employers currently put their hand in their pocket at all.

This lack of a cash employer investment must restrict the quality of delivery, which in turn does little to encourage employers to invest.

It is a cycle of underinvestment that has seen the Skills Funding Agency battle declining quality evidenced by short programmes and Train to Gain-type assessment-only delivery models.

So I applaud the government for considering a funding system that requires employers, and I hope particularly large ones, to make a cash contribution.

However, the policy makers would be wise to dust off the Banks Review of Fees — an independent review commissioned by the previous government and published in July 2010.

Within the daunting 110-page document, Chris Banks’ first and central recommendation was for the government to “match co-investment contributions received from employers up to a published maximum contribution”.

Sound familiar?

It’s a policy calling for the employer’s cash contribution that is long overdue and, using the third proposed funding model set out today, it could be fairly easy to implement for 2014/15 using current systems and rates.

In many ways it could operate like loan fees for the 24+ Advanced Learning Loans, where providers are currently charging the Student Loans Company up to a published maximum.

There are however three extra questions I would like to see in the consultation.

1. How would the government avoid over-spending the limited funding pot?

2. Should the apprenticeship minimum duration policy continue to be applied?

3. Can you avoid setting national funding rates where 100 per cent government-funded (e.g. 16 to 18-year-olds)?

Nick Linford, editor

I would strongly advise the establishment of a review of funding to be carried out by the only person who has provided continuity of insight and expertise across multiple regimes and all their twists and turns.

Hang on a second while I check if I have a note of his name………

Nick Linford!!

All 3 suggestions would seem to relay on the businesses making cash contributions? (apologies if I have read this wrong) I do not think this would work or encourage small businesses to take on apprentices, I thought the idea was to make taking on an apprentice more attractive to small businesses and to do away with red tape which would encourage sme to engage in the apprenticeship programme.

I agree with Lindsay – smaller businesses having a tough time can work with the provider to deliver an excellent training programme that benefits both learner and employer. Would they have the facility to pay for this – that I would question. There is also the issue of employers holding the drawn down funding before paying the provider. Due diligence would have to be undertaken by the provider on the employer’s financial standing as ultimately the risk is carried by the provider.

Abso-ruddy-rooting-tootly… let’s not deter the SMEs!

I think most employers would be happy to contribute financially to the training of their apprentices if what they purchased in return was high-quality training provision with industry standard resources and practices. Unfortunately there is too much poor delivery of apprenticeship training, both in the FE and private TP sector. Apprenticeship teaching & learning is often seen as secondary by colleges, with apprentices in-filling into existing FT provision or being delivered onsite by assessors via a series of meaningless Q&A booklets. If funding went straight to employers we might see providers buck their ideas up a bit and start to deliver training that was relevant and meaningful to local labour and business demands. A ggod example would be a conversation I recently had with an employer who could not understand why their Advanced Apprentice in Business & Administration wasn’t learning how to touch-type at college or how to do shorthand, both of which she considered essential skills.

Lindsay, surely if there are fewer apprentices but whose training was of better quality that is a good thing? The government push for increased starts and volumes was what caused the breakdown in quality in the first place; this led to many employers losing faith in apprenticeship training. Just ask the FSB!

Ok

1 Employers have enough problems updating Insurance details.

2 To many people will end up being lost from the industry good trainers will end up going to work for Tesco.

3 The end result is that Providers will not get paid in a timely fashion.

4 Crazy people will be starting loads of people then three months down the road the payments and job will stop and people will lose out who will then get them a fresh job to continue training.

5 Would we then have employers asking for cash back.

I could give another 10 reasons but the main thing is going back do we remember the old Individual funds about 13 years ago

Every time business has been asked contribute to trying t has failed to deliver, so we have been through the full circle YOPS, YTS, MSC,TECS, TRAINNING FOR JOBS, APPRENTICESHIPS.

This new initiative will seek to depress wages and slimline the training market in line with current economic circumstances.

The introduction of any one or all of these models would see an immediate increase in youth unemployment, right at the time when the government are trying to encourage employers of all sizes to take on more apprentices.

Insisting on employer contributions will be counter productive.

I agree Lindsay I don’t think this would work with SME’s plus haven’t we already gone through ’employer contributions’ and then had to backtrack because employers wouldn’t pay? I think it is putting another barrier in the way for businesses to engage and obviously suits the large employers like those who have been involved with Employer Ownership Of Skills Pilots. Where does the Apprenticeship Vacancy system sit within this does an employer put the vacancy on themselves or will a new online system be created?

Re employer contributions we recover the full 50% from all our employers, from sole-traders to large PLCs. None have an issue with paying providing the invoicing is (1) staged across the duration of the apprenticeship and (b)training is relevant, high-quality, challenging, flexible and reflects current industry standards. To say that employers wouldn’t pay is symptomatic of the fault of the current funding system, ie good old SFA keep paying out so why worry about looking at competitive pricing. I know of plenty of grade 1 providers who charge employer contributions because they deliver excellent training that provides value for money. Is that not correct David M?

Will be interesting to see what employers think of this, especially SMEs. At first glance options 1 and 2 look bureaucratic. What’s in it for the employer? One of the key functions of the provider currently is to manage the process to draw down funding, ensure compliance with eligibility and funding rules, qualifications, assessments and achievement claiming – i.e. make it as simple as possible for an employer to take on an apprentice. Not sure that employers will want the headache of all this.

Maybe that is where NAS approved ATAs can play a role?

if the employers we work with, small PVIs, whose employees need the main aim as a licence to practice, were expected to make a cash contribution then it would not be for a full Apprenticeship framework….resulting in existing staff invested in at the expense of new recruits

Clarity is needed with regards to the 16-18 year old funding as it appears that all employers need to contribute and then it also states that the Governement are looking to funding the 16-18 year olds more generously?

This will tie in very nicely with Fair Train, the new quality standard that was launched on Monday. Also funded by the UKCES.If anyone would like further details please contact julie.millott@fairtrain.org

Hi Tim, I have been a strong supporter of quality apprenticeships and it is once of the reasons that I started apprenticeships 4 England just over two years ago which now has 15,000 members in its linkedin groups.

Increased starts and higher numbers could be the increase of apprenticeships of people already employed, the supermarket chain which at one time was doing 1-4 apprenticeships with a small number of new employees or in the 16 – 18 age group. What we are short on is businesses engaging in the apprenticeships programme

(Over 100,000 employers in over 160,000 workplaces offer frameworks across a wide range of industry sectors) taken from NAS website.

WE have 4,000,000 businesses registered at companies house, divide that by 2 for businesses that are trading we have a lot of businesses that are not taking on apprentices, and all we seem to do is go around and around in circles. What we have to do is put a system in place that works for small businesses, how can we make a business who employs 2 -5 staff take on an apprentice, how can we make the system easy for them to use.

We’ve asked NAS, SFA and Local LEP if they can produce data on which actual employers are already committed to Apprenticeships (they can through the provider ILR returns) – so that focus can be given to those employers that aren’t. Still waiting for a reply!

It will be really interesting to see the outcome of the consultation, the routing (and transparency) of funding for work based learning (Apprenticeships) has been a grey discussion point for many years. I am slightly nervous about the ‘new online system’ as previous ‘online systems’ for Apprenticeship Vacancies (version 1), FE Choices etc have proved to be very expensive and cumbersome. There is this initial consultation to influence the policy, but then the design and build to operationalise is equally as important. It would be a good opportunity to not only review the routing for funding but also simplify further the mechanisms to a credit based currency. The issue of ‘contribution’ will be challenging as policy has steered clear of a mandatory cash requirement, challenge to the findings of the consultation – if you can’t get the ‘co-investment’ illustrated on a page of A4 it needs to be reworked.

We’re probably looking at the death of the majority of apprenticeships

Has anybody asked the SME’s and micro businesses if they want (or are able to cope with) the bureaucracy that would be involved? It’s fine for the large employers who are and will always be involved, most of which have their own contracts for Apprenticeships already, so are used to the administration demands of govt funding!

THE FSB conducted an extensive survey of members, see http://www.fsb.org.uk/news.aspx?REC=8140

Apprenticeships 4 England will be carrying out some independent research over the coming months which will be looking at all of the current issues.

Thats the death bell for Apprenticeships, what small employer with one or two staff are A. Going to have time to administer this and B. afford the cost.

Another mess up for the education system… When will governments learn?!!

Having read the proposals, I am very concerned that pushing the bureacracy to the employers will not work, some do contribute to those aged 19+ in cash, some in kind, but most already know that it is a competitive market and insist on quality, rightly so. SMEs are having a tough time of it and this will switch them off. It seems to be in direct contradiction to the push nationwide on apprentice engagement, will contribute to NEETs and cause rising unemployment among young people AND those who deliver the training. OFSTED monitor quality, and where an employer needs certain skills that are not in the framework such as touch typing, this can be delivered too. This is barmy!

What is most depressing about the comments thus far is the reluctance to look at proven models of funding from abroad. Instead we conduct endless reviews, commission endless surveys, sit in overheated rooms hearing all the old argument endlessly rehashed, snooze through endless recycled presentations. How pointless!!!

And when I hear that phrase “new online system”, all I can say is ……. unprintable

Funny that no-one has mentioned the BIS research paper, “Evaluation of Apprenticeships: Employers” (http://www.apprenticeships.org.uk/About-Us/~/media/Documents/NAS-12-813-evaluation-of-apprenticeships-employers.ashx). This was based on a large phone survey of employers who had had apprentices in the previous 18 months. Here’s the key conclusion: the number of apprentices aged 19 plus would fall by 85% if employers faced full fees and 73% lower if they paid half fees. The survey didn’t ask about the impact of paying 30% fees, but I guess that 19+ apprenticeship numbers would fall by around 50%.

The Government knows this – after all, they commissioned the survey – so it is fair to assume that they want to see a massive reduction in 19+ apprenticeships.

Incidentally, I’m astonished that the consultation paper doesn’t mention the fraud and abuse experienced when the previous government introduced Individual Learning Accounts.