With the budget less than a month away, and the prime minister confirming the apprenticeship levy needs reform, there are signs that the government could quickly revisit the original tax credit recommendation from 2012.

Education select committee chair Robert Halfon has called for the policy to be introduced on numerous occasions over the past year.

He told an Annual Apprenticeship Awards parliamentary reception last week that he finds it “incredible” that if companies invest in research and development “they get a research tax credit, hundreds of millions of pounds a year”.

“Why on earth isn’t there such a thing as a skills credit where, if companies invest in skills and apprenticeships, they get a skills tax credit from the Treasury to incentivise businesses to do more, whether it is an apprenticeship, adult learning, or whatever it may be,” Halfon added.

It is an idea favoured by Baroness Alison Wolf, who now advises the prime minister Boris Johnson on skills three days a week.

In October 2019, during an education select committee hearing, Halfon asked Wolf: “Should there not be a skill or social justice tax credit for businesses if they genuinely reskill their employees?”

The baroness replied: “I think there should – if one can figure out a way of doing it that will not be open to massive fraud. It would be a very good idea.

“As you say, you have double tax credits for research. Why not have double tax credits for training? Off the top of my head I think it is a really good idea, but like so many of these things the question is whether it is actually doable without having either a massive amount of semi-fraud or a massive amount of expensive apparatus looking at it.

“I think it would be a really interesting thing to consider.”

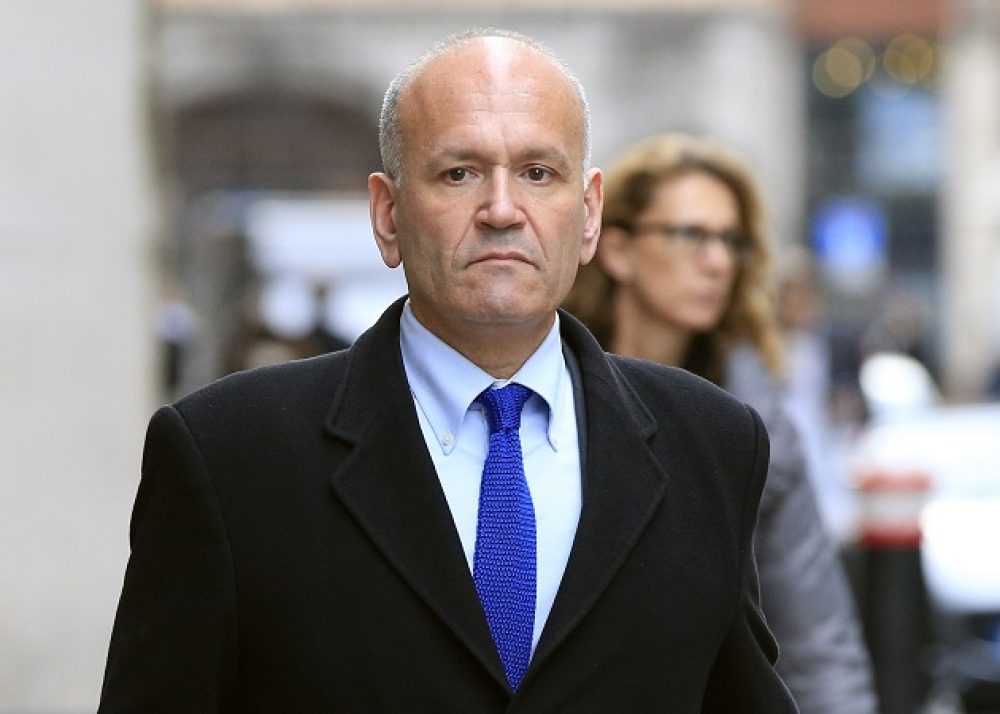

The idea of skills tax credits was first mooted in the 2012 Richard Review of Apprentices, which was conducted by former Dragons’ Den star Doug Richard (pictured).

He called for employers to pay providers directly for apprenticeship training.

Richard said tax credits, or other forms of government incentives, should then be dished out to employers as the government pays its part of apprentice training.

“Instead of the money for providers coming from the government, they [providers] now have the more granular challenge of having to collect their money from employers,” he explained.

“The employers only get the credit if they show they’ve spent the money. It means if the employer wants it done, they can’t hold the money back from the provider.”

He added: “There are differences here, profound ones, but if you net out the whole system, a provider still largely ends up providing training and getting paid through a government subsidy. But now its customer — as always should have been the case — will be the employer, not the government or one of its agencies.

“It changes who the training provider has as their customer. The customer should have the money — it focuses the mind of the vendor. I feel strongly about this point, and I think it’s the heart of the review.”

Asked if they were considering skills tax credits in the run up to the budget, a Treasury spokesperson said: “We already provide tax relief for employee training through a 100 per cent corporation tax deduction. We keep all tax reliefs under review.”

They added that in order to consider more generous tax treatment, there must be a clear economic case made for government intervention, so that any measures are well-targeted and provide value for money for the tax-payer.

The next budget will be held on March 11.

I am not one to normally applaud the ESFA, but the one hitch for the smaller providers in the plan proposed in this article is being paid by the employer.

.

The ESFA by and large pay each month on time if not necessarily in full.

Large companies frequently pay on a 90 or 120 day schedule, and this would have a massive impact on cash flow of smaller providers.

I used to be a small provider and there was a snowball’s chance in hell of any of the small (and micro) businesses paying me anything! I am now involved in delivering a Masters Apprenticeship for a University and am well aware of the debate about funding level 7+ programmes. I wonder if they might bring in a dual system where the funding is channeled through the ESFA for SMEs and lower level apprenticeships and where L4 and above is done on a tax credit system. And this, by the way, still funded by a reduced levy on large employers but perhaps at a reduced %.

Halfon presided over ‘this debacle from the onset. The disastrous register allowing one man bands, Ofsted inadequate graded providers and bankrupts on was defended until even he realised it was indefensible.

He has no credibility so I won’t hold my breath. This system need scrapping not refining.