The UK’s leading employers’ organisation has criticised the government’s new apprenticeship levy consultation for failing to explore the cost involved or the minimum size of “larger employers” set to cough-up.

While the document accompanying the consultation launched this morning said that the levy will be paid by “larger employers” in all sectors, based on “the total number of employees”, it failed to give any indication of the size of workforce this would entail.

The document, published ahead of an announcement this morning by Prime Minister David Cameron on how public procurement contracts will help boost apprenticeship numbers, added that the government wants the levy “to be calculated on the basis of employee earnings and for employers to pay the levy through their PAYE return”.

But it failed to give any indication of the cost involved, instead stating that the “rate and scope” of the levy for “all sectors” will be announced as part of the autumn spending review.

Neil Carberry, director for employment and skills at the Confederation of British Industry, told FE Week: “There isn’t anything here on rate, remit or the definition of a larger employer, which was something we think is important and does need to be discussed with employers and the sector.

“Our view is these are critical issues and the CBI will respond to them, even though the consultation does not ask for it.”

He added: “The UK is facing needs a world-class apprenticeship system which delivers the higher level skills that business and the workforce need.

“We must not sacrifice quality for quantity. While we did not support the introduction of a levy, the key thing now is that the apprenticeships it delivers meet business demand and give young people routes to great careers and higher pay.

“The best way to drive up quality is to give employers real control and ensure that levy cash is committed to only funding apprenticeships in levy-paying businesses.

“The consultation is welcome, but there is much to do to build a system that works, including deciding the rate of the levy and building a levy structure that avoids the mistakes of the past.”

A Department for Business, Innovation and Skills spokesperson said: “The threshold for what defines a larger employer will be announced in the spending review.

“This consultation will help determine what that threshold is.”, although there was no mention of a threshold or related question in the consultation.

Views are only requested in the consultation on how “the size of firm[s] should be calculated” as no system has been agreed.

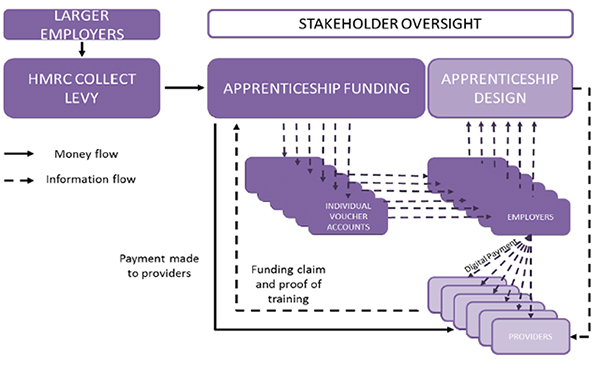

The document also said that “larger employers” would, under the proposals, claim back levy payments to fund training through a digital voucher system.

Smaller firms would be expected to use the same voucher system too, it stated, although the BIS spokesperson told FE Week last night that they would not have access to the levy fund.

He was unable to comment ahead of publication on how apprenticeships run by small firms would funded under the new system.

The document added: “We envisage that employers will receive ‘top-ups’ to their levy account over and above their own contribution,” it added.

There would though, under the plans, be “a limit” to how much employer’s voucher accounts “will be topped up each year”.

The document also raised questions over whether providers funded through the levy would need to be approved and their provision inspected.

It added that employers would be able to use the vouchers to cover all costs of an apprentice’s training, including English and maths, assessment and certification.

The consultation forms part of what the Prime Minister calls a “package of radical plans” to help the government hit its target of 3m apprenticeship starts by 2020.

The BIS spokesperson said that this would include new measures requiring all bids for government contracts worth more than £10m to “demonstrate a clear commitment to apprenticeships” from September 1.

Shadow Skills Minister Liam Byrne said that the Conservatives had made an “apparent U-turn” on the issue — after Tory MPs opposed previous Labour proposals for enforced targets on apprenticeship recruitment ahead of the general election.

Transport Secretary Patrick McLoughlin will also today announce plans to create 30,000 apprenticeships in the road and rail industry over the next five years.

Meanwhile, the government confirmed this morning that a further 59 new Trailblazer apprenticeship standards have been published, although none are “ready to deliver”.

Visit https://bisgovuk.citizenspace.com/ve/apprenticeshipslevy to download a copy of the consultation that closes on October 2.

In principle we support the concept of a levy, but as with all these things, the devil is in the detail and unfortunately there is very little of that in the consultation document.

The CBI is right to say that there needs to be clarity on employer size and a lot more information. Three other aspects also need further detail.

One is the way that this can actually work for SMEs as they will not be paying the Levy, but they employ a large proportion of the workforce. Will they receive Government funding? Do they have to come to arrangements with larger companies through their supply chains? What happens in industries such as retail where supply chains do not always work in the same way that they do in construction, engineering and manufacturing?

Secondly the current ‘interim’ funding arrangements for existing apprenticeships and Trailblazer Apprenticeships include a Government contribution funded from the Adult Skills Budget. It is not clear what will happen to this.

Finally the Trailblazer process has established that formative and end-testing assessment is to be paid independently of the training to registered Assessment Organisations. The consultation does not mention this.

I have said it before, but there is a system in place with a levy that provides Training, information, qualifications and associated services, it’s called the CITB (Construction Skills). It was an ITB that survived, and funnily enough despite some Industry criticism is still valued by the Companies and Federations that work with it – Why doesn’t the government find out how they operate?

BIS’s proposal to base levy calculations on ’employee earnings’ rather than simple headcount is significant. It reduces the cost to companies with large numbers of lower-paid employees (eg retailers and cleaning companies, already working through the implications of the big minimum wage hike), and increases it for companies with higher-paid employees (eg professional services, and much of my own sector, maritime).

That may help to make the levy more acceptable to the former, while encouraging more of the latter to think about re-shaping career programmes as apprenticeships. If that just means re-badging it’s pointless (and may be damaging), but if it prompts some genuine re-thinking it could be useful.