Learning and Skills Network (LSN) placed in administration after turnover dips by £29 million in two years and pension liability leaves an £8 million hole – but it is ‘business as usual’ for staff as buyers are sought.

Struggling for income and with a crippling multi-million pension liability, a charity with more than 25 years of experience in education has been forced into administration amid claims of diminished funding due to government spending cuts.

Ian Oakley-Smith, David Hurst and Karen Dukes of global financial experts PricewaterhouseCoopers (PwC) were last week appointed as the joint administrators of Learning and Skills Network (LSN), which provides educational expertise for businesses and agencies the public and private sector in the UK and abroad.

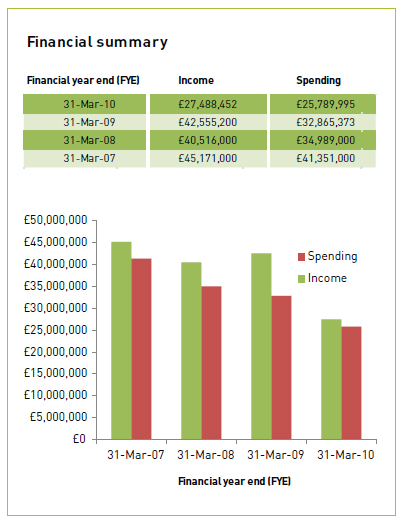

PwC say the charity, which was due to publish its annual report and financial statement this month, had a turnover of around £13 million for the 2010/11 financial year – a small figure compared to £27.5 million over the previous tax year and £42.6 million in 2008/09.

However, administrators have also revealed that although LSN has “no debt”, the charity does have a “contingent pension liability” of £8 million.

In other words, if every member of staff retired and drew their pension LSN would left with a multi-million pound deficit.

It is for those reasons that PwC say the board of trustees at LSN came to the difficult realisation that they could not carry on any further.

Mr Hurst, joint administrator and a director at PwC, said: “The charity operates a number of businesses and has suffered a dramatic decline in contract income since 2009, with its funded programmes diminished due primarily to the cuts in government spending.”

He also added: “As a result of the decline in income and significant pension liabilities within the charity, the trustees concluded that they were unable to continue and have placed the charity into administration.”

However, enquiries by FE Week have revealed the move may have taken up to nine months to make, with the Charity Commission, which regulates charities in England and Wales, aware of LSN’s financial troubles back in February.

A spokesperson for the regulator confirmed that they have been made aware of LSN’s current position but said their involvement would be limited.

The charity first contacted us in February regarding its financial position and has been providing us with regular updates on its situation”

The regulator also denied that they had been reviewing or investigating the charity prior to the news.

She said: “We have been informed by the LSN that the charity has been placed into administration.

“The Charity Commission cannot intervene in the internal administration of a charity; therefore our role in these circumstances is limited.”

However, she added: “The charity first contacted us in February regarding its financial position and has been providing us with regular updates on its situation.

“Although we have been in regular contact with LSN, we are satisfied there is currently no regulatory role for the Commission.

“We have not ‘reviewed’ or investigated the charity.”

A closer look at LSN’s financial statements for 2009/10 revealed that despite a decline in the income from the previous year, the charity had highs hopes for improvement in the proceeding year.

The report says a “new financial strategy in 2009” resulted in four key points which “will generate a significant increase in income” in 2010/11.

Those included the acquisition of three businesses at a cost to LSN of £8.87 million, a merger in July 2010 with National Extension College, the joint management of Reading College from August 2010 and also the establishment of a Shared Service programme for colleges.

These hopes caused LSN to aspire to reach an income of £50 million for 2010/11, which it planned to grow year-on-year, according to the report.

The same report also revealed the £8.87 million investment cost of the three businesses LSN acquired – FE Associates, Learning Resources International and Connections Oxford – also included £7.46 million in “goodwill”.

This would be the amount of money by which LSN paid above the net tangible assets of the three companies.

It appears there is a good deal of interest in a number of LSN’s activities and we are hopeful they will be able to continue under different ownership.”

LSN employs 117 staff over five locations – with 48 at its London base. A further 14 work at offices in Oxford, 16 in Olney, 26 in Cambridge and 13 in Belfast.

They work at five separate businesses: Technology for Learning, National Extension College (NEC), Education, Skills and Research, Development Services, Learning and Skills Development Agency (Northern Ireland) and Learning and Skills Network.

For the staff, PwC say it is “business as usual” as they look for buyers for the “successful businesses” within the charity’s structure.

Mr Hurst said: “Our immediate priority is to seek buyers to enable their long term survival, preserve jobs and continue supporting customers and students. We would encourage any interested parties to contact us as a matter of urgency.”

Although unusual to see a charity in this kind of financial situation, Mr Oakley-Smith, the director and head of charity advisory at PwC, said it is becoming more and more common.

He said: “There has been an increase in the number of financially distressed charities approaching us for advice and assistance in recent weeks and months as the Spending Review begins to impact the charities reliant on government support.”

However, Mr Oakley-Smith is confident of finding a buyer for LSN.

He added: “LSN has more than 25 years of experience of high quality delivery in the education sector.

“It is an organisation which has excellent relationships across all levels within the sector, previously working to deliver large scale projects and innovative solutions for clients including UK government and its agencies, FE institutions and large private sector clients.

“It appears there is a good deal of interest in a number of LSN’s activities and we are hopeful they will be able to continue under different ownership.”

Your thoughts