Public funds cannot be used to pay brokers’ fees, the Skills Funding Agency has officially ruled.

In its final rules for apprenticeship funding published this week, the SFA has at last clamped down on the sorts of shady dealings which have seen private bodies and brokers cream off millions of pounds via commission fees.

The decision represents a big win for FE Week, after we exposed the dodgy way brokers have been charging up to five per cent of every deal to match subcontractors with government-funded providers.

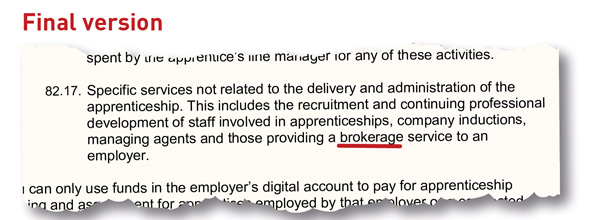

The rules now state that “funds in an employer’s digital account or government-employer co-investment must not be used for… specific services not related to the delivery and administration of the apprenticeship”. Provisions explicitly cover the recruitment and continuing professional development of staff involved in apprenticeships, company inductions, managing agents and those providing a brokerage service to an employer”.

Our initial investigation back in April found numerous brokers advertising subcontracting opportunities through closed groups on LinkedIn.

In one of those most alarming examples, FE Week found an advert with Essex-based consultants EEVT Ltd, attributed to a company called The Funding Brokers Ltd.

It read “we have been providing this service for over three years, securing in excess of £100 million in the process for our clients” – meaning that at five per cent commission, the brokers could have earned up to £5 million.

The ad continued: “We work on a no-win no-fee basis, whereby we will provide our support free of charge to the point of contracting.”

In response to our investigation, in its first bid to “limit the use of brokers”, the SFA said last April that it would “review” funding agreements – but then it fell silent.

It wasn’t until FE Week deputy editor Paul Offord’s investigation went on to win the prestigious CIPR award for Outstanding Further and Vocational Education Journalism in November, that we heard anything new, after we pressed the SFA to explain what had officially been done to address the issue.

The agency eventually revealed it would be “strengthening” its rules so that government money could no longer be used to pay brokers’ fees from May 1 this year. It also warned it would “take action” against any provider found breaking these rules.

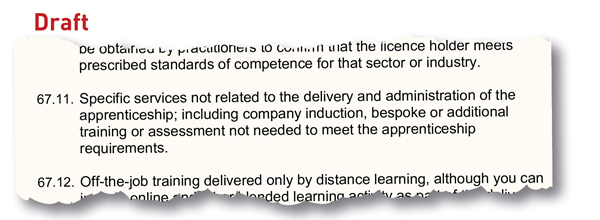

The government’s apprenticeship funding agreements originally said: “Funds in an employer’s digital account or government-employer co-investment cannot be used for specific services not related to the delivery and administration of the apprenticeship; including company induction, bespoke or additional training or assessment not needed to meet the apprenticeship requirements.”

The promise of tougher stance was warmly welcomed by sector leaders in November, shortly after FE Week first learned the change was going ahead.

Mark Dawe, the boss of the AELP, said: “With the levy’s arrival and the new subcontracting rules, no one should complain if brokerage fees become a thing of the past.”

David Hughes, his counterpart at the AoC, agreed, saying it was “good to see them delivering” on the initial pledge the SFA had made to FE Week 10 months ago.

I look forward to similar levels of zealousness, when FE Week champion the cause for management fee caps from Prime Contractors (including many colleges).

The 5% Broker Fees (and many are far less), for providing an often useful information, advice, guidance and administrative service, do seem to pale into insignificance when compared to the exorbitant management fees, prevalent across the sector.

Subcontractors have played an important role in the sector for many years but running programmes consistently at often 60% of the money the prime’s are receiving, will eventually lead to issues. Perhaps FE week could investigate the justification for such high rates, champion more realistic levels and look into the detrimental effect they have on learner experience, quality, compliance and value for money.

Whilst there are no doubt some bad apples out there, in my humble opinion these unjustified rates pose a far greater threat to the learner than that caused by bona fide brokers.

Here Here!

without brokers,how will government reach 3m???